The Spanish market is imploding, Italy is following, and the US indexes are also showing some preliminary signs of rolling over.

Consider these 3 charts...

Spain, monthly, 20yr

Italy, monthly, 20yr

US, Dow'30, monthly, 20yr

*Special note on the Spanish IBEX chart...there is a spike to 10400..its a spurious stockcharts error.

--

We are now just 79pts away from breaking the huge 7k level on the IBEX. That seems very possible..if not probable tomorrow. How will the algo-bots cope with such a threshold failing? Are we looking at another 3/5% down day on the IBEX? Lets be clear, 7k IS a truly important floor, and if the floor is taken away tomorrow morning, IBEX has an immediate downside threat of a further 2000pts.

Euro money is being vapourised

The issue occurred to me today, just how much digital Euro/Spanish money has been vapourised in the last few months due to the market falls? Are we talking about a few hundred billion? I just checked, and as at July 2011, the IBEX index was worth €350. We've fallen around a third since last summer, so...we have indeed seen losses of at least €100bn to this particular Spanish index alone. Maybe the larger figure (for all Spanish indexes/stocks) is around 150/200bn. Considering the leverage in the financial system still, are we really talking about a collective margin call of 500bn, even a trillion to Spanish related financial institutions?

It could be a very serious problem in the months ahead, as the balance sheets for Q2 are formalised.

The added issue that the Argentines just stole one of the biggest and best Spanish Oil companies (YPF)..is one giant cherry on a very toxic economic cake.

Even the mainstream financial channels are starting to discuss possible major 'civil unrest' for Spain this summer. Some very difficult months lie ahead for the Spanish people, that much is certain.

Wednesday, 18 April 2012

Closing Brief

I am so glad to see today come to a close. That little 2pm bounce sure had me a little concerned, but it failed at the 10MA..perfectly.

I believe that bounce was probably a micro-wave 2'UP. If that is correct, the next wave is '3...and should be at least 15pts lower on Sp...however, if Europe is spooked tomorrow (bond auctions, imploding Spanish stock market), then maybe we're looking at -25/30pts ? Its an exciting thought.

Sp'15min

Sp'60min

VIX'60min

The one concern for the bears would be the VIX, which closed flat. Not sure what to make of the VIX, although sometimes it does lag for no apparent reason.

Much more later this evening (as usual), I'll be looking over the daily cycles, and probably a few other things too!

Good wishes for what could be an exciting Thursday.

--

ps. Hello to all at PUG (whoever all you people are!).

I believe that bounce was probably a micro-wave 2'UP. If that is correct, the next wave is '3...and should be at least 15pts lower on Sp...however, if Europe is spooked tomorrow (bond auctions, imploding Spanish stock market), then maybe we're looking at -25/30pts ? Its an exciting thought.

Sp'15min

Sp'60min

VIX'60min

The one concern for the bears would be the VIX, which closed flat. Not sure what to make of the VIX, although sometimes it does lag for no apparent reason.

Much more later this evening (as usual), I'll be looking over the daily cycles, and probably a few other things too!

Good wishes for what could be an exciting Thursday.

--

ps. Hello to all at PUG (whoever all you people are!).

2pm Update - the bearish daily outlook

Market is certainly looking weak...sp'1395/1405 now looks out of range..and a move to 1340 is most definitely on the agenda.

Lets look at a more bearish chart..something a few of doomers might like

SP' daily - bearish outlook

*special note...

The 10MA will cross the 50 day MA tomorrow, that statistical event WILL trigger some automatic sell programs tomorrow morning.

--

As in the previous bullish outlook, 1340 and 1300 are key levels.

The point on this chart to note is if we can somehow get down to 1270/50 zone -where the 200day MA also lurks. It would make for a very nice wave'1 (black count)...before a little 2' up...and then a seriously major wave'3 lower in late May/June.

Such a wave'3 would be looking to hit the lower channel of the monthly wedge - currently somewhere around 1150/1200 zone..as you see.....

SP'monthly..simple chart.

More later...after the close.

Lets look at a more bearish chart..something a few of doomers might like

SP' daily - bearish outlook

*special note...

The 10MA will cross the 50 day MA tomorrow, that statistical event WILL trigger some automatic sell programs tomorrow morning.

--

As in the previous bullish outlook, 1340 and 1300 are key levels.

The point on this chart to note is if we can somehow get down to 1270/50 zone -where the 200day MA also lurks. It would make for a very nice wave'1 (black count)...before a little 2' up...and then a seriously major wave'3 lower in late May/June.

Such a wave'3 would be looking to hit the lower channel of the monthly wedge - currently somewhere around 1150/1200 zone..as you see.....

SP'monthly..simple chart.

More later...after the close.

1pm Update - Daily cycle, bear flag ;)

Whilst the smaller 15 and 60 minute cycles will do their own thing this afternoon, lets keep things in perspective, with a look at the daily cycle. We have a very clear bear flag on the daily cycle.

Sp, daily - bullish outlook

Now, this is a bullish scenario chart, but I've stuck on a simple near term bearish count, which I believe will be useful to keep in mind in the coming days.

1340 remains the prime target...but 1300 is certainly feasible - when you consider the weekly and monthly cycles...and those European indexes!

More later.. !

Sp, daily - bullish outlook

Now, this is a bullish scenario chart, but I've stuck on a simple near term bearish count, which I believe will be useful to keep in mind in the coming days.

1340 remains the prime target...but 1300 is certainly feasible - when you consider the weekly and monthly cycles...and those European indexes!

More later.. !

12pm Update - little wave'3 underway

Okay..so.. a bit of a messy open...a gap lower..then quick bounce...then fast failure at the 10MA (15min cycle)..and now we're pretty much just slipping lower.

I am short, and intending to hold short until sp'1340..sometime next week.

-

Sp'60min

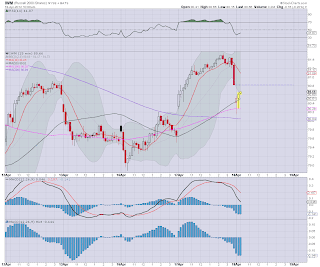

IWM'60min

VIX'60min

Bears will want to see VIX break 21. It doesn't have to be this week, but certainly, sometime early next week...and then a charge to 24. If we see VIX over 27 at ANY point, we'll be in danger of flashing down much lower in the indexes, after 1340 the next key levels would be 1300, then 1270/50.

First things first though...1340.

Good wishes to all the brave bears out there!

I am short, and intending to hold short until sp'1340..sometime next week.

-

Sp'60min

IWM'60min

VIX'60min

Bears will want to see VIX break 21. It doesn't have to be this week, but certainly, sometime early next week...and then a charge to 24. If we see VIX over 27 at ANY point, we'll be in danger of flashing down much lower in the indexes, after 1340 the next key levels would be 1300, then 1270/50.

First things first though...1340.

Good wishes to all the brave bears out there!

11am update - WEAK market

okay, I am now short...market failed at the 10MA on the 15min cycle charts, even weaker than expected.

IWM 60min

IWM 60min

Very annoying market, it looks like yesterday afternoon was the prime time to short. I suppose the only thing that could be more annoying, would be for the market to surge in latter part of today to sp'1400. Urghh.

10am Update

okie..we're off and running.

The opening move lower has exhausted the 15min cycle, so we're getting a bounce this morning. That will give bulls another chance to exit..and bears a better level to short from. Everyone can be happy then? ;)

How high will the bounce go ? Hard to say, we could easily still push one further high, and that's why I am patiently waiting to short, rather than whacking buttons like a maniac.

IWM 15min'

SP'60min - bearish outlook

I certainly believe today will probably be a fairly good day to short, but right now..there is no hurry..at least for a few hours.

More later...throughout the day!

The opening move lower has exhausted the 15min cycle, so we're getting a bounce this morning. That will give bulls another chance to exit..and bears a better level to short from. Everyone can be happy then? ;)

How high will the bounce go ? Hard to say, we could easily still push one further high, and that's why I am patiently waiting to short, rather than whacking buttons like a maniac.

IWM 15min'

SP'60min - bearish outlook

I certainly believe today will probably be a fairly good day to short, but right now..there is no hurry..at least for a few hours.

More later...throughout the day!

European Markets..cliff fall?

In my regular world index updates I've especially noted the severe weakness in the two major PIIGS - Italy and Spain. The Spanish IBEX is now in imminent danger of breaking an absolutely huge level.

For 'near' real time updates on IBEX - see: http://finance.yahoo.com/q?s=^IBEX&ql=0

Spain, monthly, 20yr historic.

As at 8am EST, the IBEX is down another 3.1% at 7143.

The IBEX is now just 2% away from breaking <7k.

In my view a break of 7k immediately opens the door, and almost guarantees a fall to 5k- within the next 1-6 months. Italy, and other Euro' indexes are certainly not as weak as the IBEX, but they ARE following in terms of a new bearish trend.

Without question, the IBEX is now the biggest warning to the bullish case. Watch that 7000 level. If it fails to hold....things could get.... real interesting.

For 'near' real time updates on IBEX - see: http://finance.yahoo.com/q?s=^IBEX&ql=0

Spain, monthly, 20yr historic.

As at 8am EST, the IBEX is down another 3.1% at 7143.

The IBEX is now just 2% away from breaking <7k.

In my view a break of 7k immediately opens the door, and almost guarantees a fall to 5k- within the next 1-6 months. Italy, and other Euro' indexes are certainly not as weak as the IBEX, but they ARE following in terms of a new bearish trend.

Without question, the IBEX is now the biggest warning to the bullish case. Watch that 7000 level. If it fails to hold....things could get.... real interesting.

Pre-market Brief

Looks like IWM selling off at the close last night was the clue for how we open today.

As at 7.45am EST, dow looks set to open -50/75pts. Given 15/30mins by 10am, dow could easily be down 100pts.

-

Arguably, there is no point shorting at the open, the 15min cycle is already kinda low on the MACD cycle. A few good people out there also suggests we'll still hit sp'1400 late today or early Thursday. So the bears would do well to at least wait a few hours today before hitting any buttons.

Dow 15min

So right now, I will let them wash out the weak bulls, and see lets see how strongly they buy this up in the latter part of the morning.

As at 7.45am EST, dow looks set to open -50/75pts. Given 15/30mins by 10am, dow could easily be down 100pts.

-

Arguably, there is no point shorting at the open, the 15min cycle is already kinda low on the MACD cycle. A few good people out there also suggests we'll still hit sp'1400 late today or early Thursday. So the bears would do well to at least wait a few hours today before hitting any buttons.

Dow 15min

So right now, I will let them wash out the weak bulls, and see lets see how strongly they buy this up in the latter part of the morning.

Something for the doomers to worry about

There is a lot of chatter out there this evening about a potential down cycle, with varying targets of 1340, 1300, even 1270/50.

Here is something to consider....

IWM, weekly...the bullish count

Its only a 4...yes?

A few have noted that we may indeed only be in a wave'4, much in the style of the earlier wave'2. If this is the case, IWM would floor around 75/76...and then proceed to make new highs in May/July period, perhaps as high as the low 90s. I suppose there is always the 'truncated' fifth wave idea too.

Interestingly, the 76.00 level on IWM, would match up with a few of the other key levels/moving averages on both the daily and monthly cycles.

So, 'if' we do cycle lower next week, and get as low as 1340, with IWM at 76, the doomers (myself included) will need to be real careful.

*I believe IWM 76.0 would equate to SP'1335/45, and Dow 12200/400

Goodnight

Here is something to consider....

IWM, weekly...the bullish count

Its only a 4...yes?

A few have noted that we may indeed only be in a wave'4, much in the style of the earlier wave'2. If this is the case, IWM would floor around 75/76...and then proceed to make new highs in May/July period, perhaps as high as the low 90s. I suppose there is always the 'truncated' fifth wave idea too.

Interestingly, the 76.00 level on IWM, would match up with a few of the other key levels/moving averages on both the daily and monthly cycles.

So, 'if' we do cycle lower next week, and get as low as 1340, with IWM at 76, the doomers (myself included) will need to be real careful.

*I believe IWM 76.0 would equate to SP'1335/45, and Dow 12200/400

Goodnight

Indexes...ready to snap lower

Taking into account the 60min cycle - which is pretty close to being maxed out, I'm guessing we are due to cycle lower again starting as early as the latter part of Wednesday.

Lets look at those daily cycles!

IWM, daily

SP, daily

Transports, daily

Summary

Wednesday will be a very important day. We'll be just 2 days away from opex, and if we're around sp'1400, we'll be some 40pts higher that the recent low. Some degree of pullback seems highly probable.

Anyone shorting tomorrow with serious money, should surely have a stop around sp'1410/15. Any price moves above that level, and its very viable we'll just keep on going - not least since the weekly/monthly cycles will start to flip back to bullish.

Good wishes

Lets look at those daily cycles!

IWM, daily

SP, daily

Transports, daily

Summary

Wednesday will be a very important day. We'll be just 2 days away from opex, and if we're around sp'1400, we'll be some 40pts higher that the recent low. Some degree of pullback seems highly probable.

Anyone shorting tomorrow with serious money, should surely have a stop around sp'1410/15. Any price moves above that level, and its very viable we'll just keep on going - not least since the weekly/monthly cycles will start to flip back to bullish.

Good wishes

Subscribe to:

Comments (Atom)