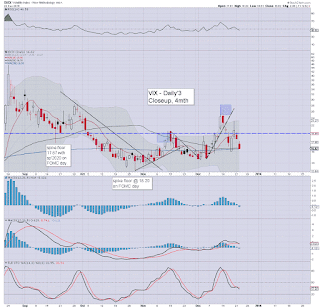

With Santa almost here, equities closed higher for a second consecutive day, and the VIX naturally continued to cool, settling -11.2% @ 16.60. Near term outlook is for continued equity upside into early 2016, and that will likely equate to VIX in the very low teens.

VIX'60min

VIX'daily3

Summary

Little to add.

What should be clear, with the Fed having raised rates last week, a big chunk of uncertainty - and thus volatility, has been removed from the market.

The VIX will likely remain subdued into early 2016.

--

more later... on the indexes

Tuesday, 22 December 2015

Closing Brief

US equity indexes closed broadly higher for the second consecutive day, sp +17pts @ 2038. The two leaders - Trans/R2K, settled higher by 1.5% and 0.9% respectively. Near term outlook offers a lot of chop, but with underlying seasonal upward pressure. Right now, a year end close >2065 looks probable.

sp'60min

Summary

*closing hour action: a little surge to a new intra high of 2042, but then cooling to the mid 2030s.

There is very natural resistance at the hourly upper bollinger.

-

So.. a second day of gains... as we're another day closer to Santa.

We're clearly headed broadly higher into end year, although right now, a year end close in the 2100s looks difficult.. even if Oil pushes upward.

--

more later.. on the indexes

sp'60min

Summary

*closing hour action: a little surge to a new intra high of 2042, but then cooling to the mid 2030s.

There is very natural resistance at the hourly upper bollinger.

-

So.. a second day of gains... as we're another day closer to Santa.

We're clearly headed broadly higher into end year, although right now, a year end close in the 2100s looks difficult.. even if Oil pushes upward.

--

more later.. on the indexes

3pm update - a second day of gains

US equity indexes are set for a second consecutive net daily gain, with the sp' due to settle within the 2030s. Wed' offers construction of a baby bull flag, before the week settles in the 2045/50 zone. More significant strength looks due next week, to close the year above the 50/200 day MAs

sp'60min

USO, daily2

Summary

Little to add.

The gains in Oil are still within a broader down trend. Even if Oil can claw to the $40 threshold within the next few weeks, it will do nothing to suggest the collapse wave from summer 2014 is over.

Indeed, there is still very little industry capitulation in the oil sector.. nor for that matter, in precious metals/mining.

For the drivers out there.. and almost everyone... low oil/energy prices remain one of the distinct good things across this year.

-

back at the close

sp'60min

USO, daily2

Summary

Little to add.

The gains in Oil are still within a broader down trend. Even if Oil can claw to the $40 threshold within the next few weeks, it will do nothing to suggest the collapse wave from summer 2014 is over.

Indeed, there is still very little industry capitulation in the oil sector.. nor for that matter, in precious metals/mining.

For the drivers out there.. and almost everyone... low oil/energy prices remain one of the distinct good things across this year.

-

back at the close

Subscribe to:

Posts (Atom)