With the main indexes continuing to melt higher, the VIX is back on the slide again, closing -1.9% @ 13.31. Even the VIX 14 seems a difficult barrier to break. There remains potential for a brief spike to 15/16, but 18s now seem out of range..for some months.

VIX'60min

VIX'daily

Summary

Another day of painful - and utterly mind numbing, algo-bot melt.

It was no surprise to see the VIX slip lower, and its almost a wonder that we're not already trading in the 11s..or even 10s.

The upper bollinger band - see daily chart, is still collapsing, and is now down to 15.98. By the end of this week, it'll probably be around 14.

So..those hopes of VIX in the 16-18 gap fill zone are going to be nigh impossible after this week.

I suppose its possible we could yet hit 14/15..pull back..then battle higher next week..but still..why would next week be any different than this week?

More later..on the indexes

Tuesday, 29 January 2013

Closing Brief - another day of melt

Another day higher, but then...why would it end? We're now 109 pts higher than the Dec'31st low - a mere 20 trading days ago. There is no sign of a turn..and the much sought retracement remains just that....sought, but missing.

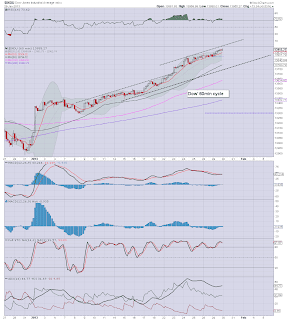

The hourly charts are bizarrely simple. What more is needed other than two straight upward sloping channel lines?

Dow'60min

sp'60min

Trans'60min

Summary

The algo-bot melt continues..and we're already now brushing up against what was the Feb/March target zone of 1510/20.

It has to be said, we ARE in the twilight zone of a new market era.

It needs to be considered..that this could continue...for some years to come.

--

*AMZN earnings...lousy. Q4 EPS 21 cents. The market was seeking 28 cents.

They still can't muster a decent profit..not even mediocre. Stock is -5%..which frankly is nothing of any significance. It remains over-valued by 90%, but hey..its the new era of stock valuations.

The hourly charts are bizarrely simple. What more is needed other than two straight upward sloping channel lines?

Dow'60min

sp'60min

Trans'60min

Summary

The algo-bot melt continues..and we're already now brushing up against what was the Feb/March target zone of 1510/20.

It has to be said, we ARE in the twilight zone of a new market era.

It needs to be considered..that this could continue...for some years to come.

--

*AMZN earnings...lousy. Q4 EPS 21 cents. The market was seeking 28 cents.

They still can't muster a decent profit..not even mediocre. Stock is -5%..which frankly is nothing of any significance. It remains over-valued by 90%, but hey..its the new era of stock valuations.

2pm update - relentless melt

Its just another day of algo-bot melt..fuelled by POMO $. How many more trading days will be necessary for the bears to fully capitulate? 50, 100, 500? Will it really take 1000 days for the very last bear in this market to understand what was meant by Bernanke last September when he announced QE3 t-bond buying (POMO)..'without end'.

Which part of 'without end' is confusing? It is the 'without'.. or the 'end' ?

I sure see a lot of bear maniacs posting cute little pics of a tiny little QE3/4 box on index charts..yet...for some reason they are making the bizarre notion that this QE is going to end. I don't get it, but then I happen to believe 'without end' means..the money printing is not scheduled to end.

I guess I'll remain the only one highlighting that little 'minor issue'.

--

sp'daily5

vix'daily3

Summary

So much for the VIX showing any strength, a close in the 12s now looks easily within range.

If Market likes the econ-data tomorrow, 1510/20s. but hey....even if its lousy numbers..what does it matter? Bulls have the algo-bots..and the Bernanke $.

--

AMZN earning at the close.

Very hard to guess whether that nonsense will ramp 20% on even lower - or NO margins, or whether they'll whack it 10/20% lower..only for it melt back higher into the spring.

After all, its AMZN, and it remains surrounded by hysteria.

-

back after the close.

Which part of 'without end' is confusing? It is the 'without'.. or the 'end' ?

I sure see a lot of bear maniacs posting cute little pics of a tiny little QE3/4 box on index charts..yet...for some reason they are making the bizarre notion that this QE is going to end. I don't get it, but then I happen to believe 'without end' means..the money printing is not scheduled to end.

I guess I'll remain the only one highlighting that little 'minor issue'.

--

sp'daily5

vix'daily3

Summary

So much for the VIX showing any strength, a close in the 12s now looks easily within range.

If Market likes the econ-data tomorrow, 1510/20s. but hey....even if its lousy numbers..what does it matter? Bulls have the algo-bots..and the Bernanke $.

--

AMZN earning at the close.

Very hard to guess whether that nonsense will ramp 20% on even lower - or NO margins, or whether they'll whack it 10/20% lower..only for it melt back higher into the spring.

After all, its AMZN, and it remains surrounded by hysteria.

-

back after the close.

Subscribe to:

Posts (Atom)