Good morning. The daily and weekly cycles are all primed to see some sort of significant snap lower this week. Primary target is sp'1420, that is a mere 2% lower, and is not exactly asking much, is it?

sp'daily5

vix'daily

Summary

It should be a fair week for the bears,

As noted though many times, for the doomers out there, only if we break the previous main cycle low of 1397 can anything major be considered.

For the moment, lets see if we can close today <1450.

I remain short, and seeking a 1420 exit.

*amusing to see the mighty Barrons start touting FB as a $15 stock. Didn't I say that at the IPO? Of course, its really only worth a few dollars.

More across the day.

Monday, 24 September 2012

Sunday, 23 September 2012

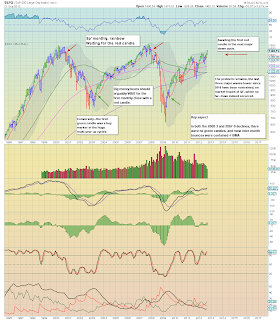

Weekend update - somewhere...over the rainbow

The broader indexes - such as the SP'500, Dow, NYSE Comp, and the NASDAQ all remain outright bullish, sporting green candles on the rainbow charts. For the moment, only the transports remains weak, and is presently set to put in a second red candle on the monthly chart.

sp, monthly, rainbow, 3b

sp, monthly, rainbow, 3c

sp, monthly, rainbow, 3e

Summary

The bears face a real problem. The primary trend on the main indexes is unquestionably still bullish. There is just no sign of this latest rally from the June sp'1266 low ending.

As I've noted before recently, two things need to be reflected upon. At the current rate of trend, we'll close the year around sp'1600, and comfortably hit sp'1800 by end'2013. That assumes no major upsets, black swans, or 'end of the world' events as such. ;)

Anyone currently shorting for more than a few days at a time, is arguably standing in front of what remains a freight train, driven by none other than the Ben Bernanke. A disturbing image, to be sure.

Yet, there remains one major warning of trouble out there....

A reminder on the transports...

The transports - aka, 'old leader' sure doesn't look as bullish as the more broader sp'500 - or the dow, or even the NYSE Comp'. It is badly lagging, and has been stuck in a tight range since January of this year.

Awaiting a few red flags at the end of September

I suppose its somewhat arbitrary to define a given close at the end of a month as more vital than any other day, but still, what else can we do?

So, at the end of next week..and the trading month I want to see....

1. Transports, red candle for the month, with a close under the 5000 level.

2. Oil...back under $90

3. Dollar, weekly MACD (blue bar histogram) cycle, levelling out

4. VIX, back over 16, preferably 18, and without question, until the VIX breaks back into the 20s, any VIX moves (with corresponding index declines) are very unreliable.

It has to be said, even the transports closing <5k seems a lot to hope for. It really won't take much for the market to have another kick higher, and break into the sp'1500s. As ever, we'll just have to see what happens.

One thing is for sure, an 'October surprise'..is possible, but it may merely be yet another leg to the upside.

Back on Monday....good wishes from London city.

sp, monthly, rainbow, 3b

sp, monthly, rainbow, 3c

sp, monthly, rainbow, 3e

Summary

The bears face a real problem. The primary trend on the main indexes is unquestionably still bullish. There is just no sign of this latest rally from the June sp'1266 low ending.

As I've noted before recently, two things need to be reflected upon. At the current rate of trend, we'll close the year around sp'1600, and comfortably hit sp'1800 by end'2013. That assumes no major upsets, black swans, or 'end of the world' events as such. ;)

Anyone currently shorting for more than a few days at a time, is arguably standing in front of what remains a freight train, driven by none other than the Ben Bernanke. A disturbing image, to be sure.

Yet, there remains one major warning of trouble out there....

A reminder on the transports...

The transports - aka, 'old leader' sure doesn't look as bullish as the more broader sp'500 - or the dow, or even the NYSE Comp'. It is badly lagging, and has been stuck in a tight range since January of this year.

Awaiting a few red flags at the end of September

I suppose its somewhat arbitrary to define a given close at the end of a month as more vital than any other day, but still, what else can we do?

So, at the end of next week..and the trading month I want to see....

1. Transports, red candle for the month, with a close under the 5000 level.

2. Oil...back under $90

3. Dollar, weekly MACD (blue bar histogram) cycle, levelling out

4. VIX, back over 16, preferably 18, and without question, until the VIX breaks back into the 20s, any VIX moves (with corresponding index declines) are very unreliable.

It has to be said, even the transports closing <5k seems a lot to hope for. It really won't take much for the market to have another kick higher, and break into the sp'1500s. As ever, we'll just have to see what happens.

One thing is for sure, an 'October surprise'..is possible, but it may merely be yet another leg to the upside.

Back on Monday....good wishes from London city.

Saturday, 22 September 2012

A major reversal week for the tranny

Whilst the main indexes held their gains of recent weeks, the transports closed the week with a loss of almost 6%. Not only is the drop a sizable one, but we have a weekly close below the key 5000 level.

Trans, weekly

Trans, monthly, rainbow

Summary

The transports is now becoming the centre of attention for many market watchers out there. The 'old leader' has certainly seen some major down moves this week, and yet the other indexes seem completely able to just ignore it. The question is now 'will the other indexes catch up?'.

I remain waiting to see how the tranny closes the month, I continue to seek a monthly close under the 5k level - with a second red candle, so, lets see if next week keeps the tranny under 5000.

More across the weekend... (probably)

Goodnight from London

Trans, weekly

Trans, monthly, rainbow

Summary

The transports is now becoming the centre of attention for many market watchers out there. The 'old leader' has certainly seen some major down moves this week, and yet the other indexes seem completely able to just ignore it. The question is now 'will the other indexes catch up?'.

I remain waiting to see how the tranny closes the month, I continue to seek a monthly close under the 5k level - with a second red candle, so, lets see if next week keeps the tranny under 5000.

More across the weekend... (probably)

Goodnight from London

Subscribe to:

Posts (Atom)