The hourly cycle looks a bit toppy, and we certainly could close marginally red. Yet, sp'1350/60 target zone looks still very much on track.

Whilst the market is relatively quiet...a reminder on my primary near term outlook into July/August. Both the weekly and monthly cycles support this.

sp' daily'9, bearish July outlook

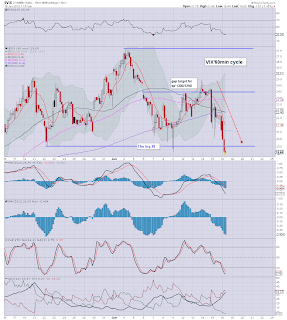

sp'60min

Summary

The hourly cycle shows a near perfect standard ABC wave'2. Everything is on track. The next key fib' level is 1363..so.. that is one target to keep in mind this Wednesday - as a 'spike high' after the FOMC announce their latest meddling in our supposedly 'free capitalist market'

--

*not sure if there is a problem with Disque today. To the person who posted via google, it only appeared to me via email, but thanks for your kind comment anyway.

Monday, 18 June 2012

1pm update - sleepy afternoon

A quiet and sleepy afternoon likely lies ahead for this nasty algo-bot ridden market - baring some crazy Reuters rumour/s of course!

sp'60min

Summary

Bears can NOT expect any serious downside until AFTER the FOMC on Wednesday. Shorting at these level...and at this time, is probably not the best of ideas. Patience.

---

Notable stock of the day...so far...

FB, daily

The bull maniacs are chasing it higher, I'd guess it will get stuck around 33/35. Max' upside would be a complete backtest of the original IPO $38 level. Mid-term target remains the teens.

Stay tuned!

sp'60min

Summary

Bears can NOT expect any serious downside until AFTER the FOMC on Wednesday. Shorting at these level...and at this time, is probably not the best of ideas. Patience.

---

Notable stock of the day...so far...

FB, daily

The bull maniacs are chasing it higher, I'd guess it will get stuck around 33/35. Max' upside would be a complete backtest of the original IPO $38 level. Mid-term target remains the teens.

Stay tuned!

12pm update - lunch time chop

Early losses, then minute gains, and now back to moderate losses. Considering the great concern over the weekend this chop-fest is to be expected.

This small scale battle between bulls/bears seems likely to continue for some hours. However, the underlying bias remains UP. So...the wise and patient bears will be staying away from this skirmish.

Sp'60min

vix'60min

Summary

Nothing much else to add....I'd still guess we close moderately green. That sets up for a move into the 1350s either tomorrow or early Wednesday.

Whether we can break to the secondary target zone of 1380/90 by this Friday, that is arguably entirely dependent upon the action of the FOMC.

The monthly cycle 'bigger picture' target remains sp'1150/00 by end July.

Time for lunch!

This small scale battle between bulls/bears seems likely to continue for some hours. However, the underlying bias remains UP. So...the wise and patient bears will be staying away from this skirmish.

Sp'60min

vix'60min

Summary

Nothing much else to add....I'd still guess we close moderately green. That sets up for a move into the 1350s either tomorrow or early Wednesday.

Whether we can break to the secondary target zone of 1380/90 by this Friday, that is arguably entirely dependent upon the action of the FOMC.

The monthly cycle 'bigger picture' target remains sp'1150/00 by end July.

Time for lunch!

Subscribe to:

Posts (Atom)