Friday, 31 January 2020

Leaving the EU

--

The United Kingdom left the European Union at 11pm GMT, Jan'31st 2020.

Yours, no longer an EU citizen.

Thursday, 30 January 2020

Corona induced swings

US equity indexes mostly closed a little higher, sp +10pts (0.3%) at 3283. Nasdaq comp' +0.3%. Dow +0.4%. The Transports settled -0.6%.

sp'daily5

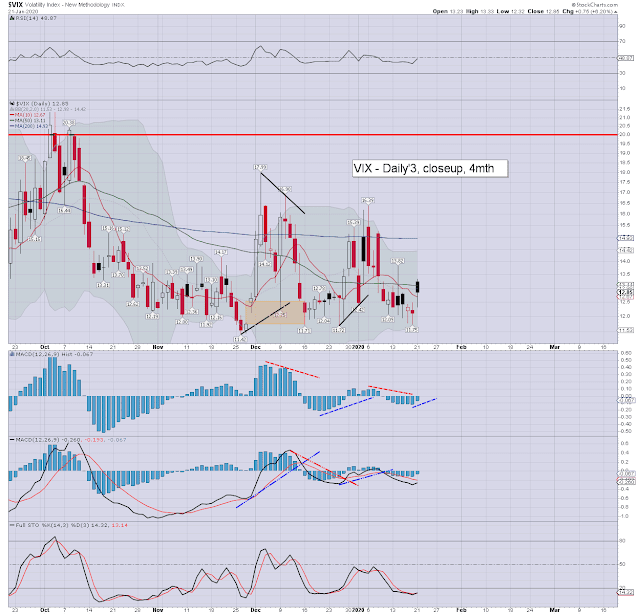

VIX'daily3

Summary

US equities opened broadly lower, there was an opening reversal, but that reversal was itself reversed, with the market seeing an afternoon low of 3242. Further Corona news from the CDC and WHO saw the market have some rather strong swings, but ending with a late day ramp to settle net higher.

Volatility was itself volatile, seeing a high of 18.39, but settling -5.5% to 15.49. The s/t cyclical setup favours the equity bulls for early Friday, but the market looks extremely vulnerable into early next week.

-

Your views...

73% of you don't agree with Calhoun, and it is pleasing that most now understand the 737MAX is a fatally flawed design. Yet Boeing and their bed-fellow - the FAA, are absolutely intent on seeing it fly again.

--

--

Extra charts in AH (usually around 5pm EST) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: Permabeardoomster.com

sp'daily5

VIX'daily3

Summary

US equities opened broadly lower, there was an opening reversal, but that reversal was itself reversed, with the market seeing an afternoon low of 3242. Further Corona news from the CDC and WHO saw the market have some rather strong swings, but ending with a late day ramp to settle net higher.

Volatility was itself volatile, seeing a high of 18.39, but settling -5.5% to 15.49. The s/t cyclical setup favours the equity bulls for early Friday, but the market looks extremely vulnerable into early next week.

-

Your views...

73% of you don't agree with Calhoun, and it is pleasing that most now understand the 737MAX is a fatally flawed design. Yet Boeing and their bed-fellow - the FAA, are absolutely intent on seeing it fly again.

--

|

Extra charts in AH (usually around 5pm EST) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: Permabeardoomster.com

Wednesday, 29 January 2020

Horrible numbers from a rotting company

US equity indexes closed a little mixed, sp -2pts (0.1%) at 3273. Nasdaq comp' +0.1%. The Transports settled +0.4%. The s/t cyclical setup will favour the equity bears into the weekend/end month.

sp'daily5

VIX'daily3

Summary

US equities opened moderately higher, but there was an opening reversal, with the SPX turning fractionally red in the 10am hour. A secondary wave higher into early afternoon failed to fully close the Monday gap.

Powell appeared...

As expected, it was a 'do nothing fed', and I'd expect the US President to issue further complaints in the coming days. The late afternoon saw some cooling, with a clear s/t cyclical rollover.

Volatility was subdued, with the VIX seeing a low of 14.94, but settling +0.7% at 16.39. The s/t cyclical setup will favour the equity bears across the remainder of the week/month.

--

Horrible numbers from a rotting company

Boeing (BA) posted earnings: EPS -$2.33 vs -1.83est. Rev' y/y -36.8% to $17.9bn vs 21.8bn. On any basis.... horrible.

The full interview with CEO Calhoun...

In reference to the 737MAX, Calhoun (t+2:45) "... it is a fundamentally sound airplane".

Perhaps Calhoun/Boeing's interpretation of the term 'fundamentally sound' is just different from yours truly.

I certainly don't see the 737MAX as flight worthy. Without getting into the details, the plane is inherently unbalanced, and should never have been granted permission to fly. Ohh, and yes, I'd also see the FAA as only marginally less 'problematic' than Boeing itself. Its become clear, even to some within the mainstream, that the FAA and Boeing are 'in bed together', and its contributed to two crashed planes, with the death of 346 innocents.

For the record, I have little other than contempt for Calhoun. Lets be clear, he has been part of the Boeing board since 2009, and by definition, part of the group that approved the 737MAX.

Whilst the stock settled today net higher by +1.7% to $322.02, broader price structure ain't pretty, with a giant H/S formation.

Any price action <285s will merit alarm bells, and offer the 140s. I'd accept that as 'crazy talk' for now, but then so was 'GE to the $7s', when it broke <$27 in 2017.

I will end by noting I do see Boeing as a company with serious internal rot, as one of Boeing's employees deemed the 737MAX as '... designed by clowns, and supervised by Monkeys'.

--

--

Extra charts in AH (usually around 5pm EST) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: Permabeardoomster.com

sp'daily5

VIX'daily3

Summary

US equities opened moderately higher, but there was an opening reversal, with the SPX turning fractionally red in the 10am hour. A secondary wave higher into early afternoon failed to fully close the Monday gap.

Powell appeared...

As expected, it was a 'do nothing fed', and I'd expect the US President to issue further complaints in the coming days. The late afternoon saw some cooling, with a clear s/t cyclical rollover.

Volatility was subdued, with the VIX seeing a low of 14.94, but settling +0.7% at 16.39. The s/t cyclical setup will favour the equity bears across the remainder of the week/month.

--

Horrible numbers from a rotting company

Boeing (BA) posted earnings: EPS -$2.33 vs -1.83est. Rev' y/y -36.8% to $17.9bn vs 21.8bn. On any basis.... horrible.

The full interview with CEO Calhoun...

In reference to the 737MAX, Calhoun (t+2:45) "... it is a fundamentally sound airplane".

Perhaps Calhoun/Boeing's interpretation of the term 'fundamentally sound' is just different from yours truly.

|

| Definitely not a 737MAX |

I certainly don't see the 737MAX as flight worthy. Without getting into the details, the plane is inherently unbalanced, and should never have been granted permission to fly. Ohh, and yes, I'd also see the FAA as only marginally less 'problematic' than Boeing itself. Its become clear, even to some within the mainstream, that the FAA and Boeing are 'in bed together', and its contributed to two crashed planes, with the death of 346 innocents.

For the record, I have little other than contempt for Calhoun. Lets be clear, he has been part of the Boeing board since 2009, and by definition, part of the group that approved the 737MAX.

Whilst the stock settled today net higher by +1.7% to $322.02, broader price structure ain't pretty, with a giant H/S formation.

Any price action <285s will merit alarm bells, and offer the 140s. I'd accept that as 'crazy talk' for now, but then so was 'GE to the $7s', when it broke <$27 in 2017.

I will end by noting I do see Boeing as a company with serious internal rot, as one of Boeing's employees deemed the 737MAX as '... designed by clowns, and supervised by Monkeys'.

--

|

| The days continue to get longer |

|

| The setting crescent moon and Venus |

|

| Full moon... Feb'9th |

Extra charts in AH (usually around 5pm EST) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: Permabeardoomster.com

Tuesday, 28 January 2020

The flame of equities

US equity indexes closed significantly higher, sp +32pts (1.0%) at 3276. Nasdaq comp' +1.4%. Dow +0.6%. The Transports settled +0.6%.

sp'daily5

VIX'daily3

Summary

US equities opened moderately higher, and built significant gains into the afternoon.

Trump had the time in mid morning...

Again, we have the US President calling for lower rates, all that is missing is a request for renewed QE... which of course, we already have.

Ms Yoon of CNBC made another appearance...

So, which is it? Did Eunice run out of masks, consider the threat less problematic than yesterday, or was told to 'lose the mask' by corporate HQ or the local communists?

Volatility was in cooling mode, with the VIX settling -10.7% at 16.28. S/t outlook offers another equity swing lower - once the fed are out of the way, to break under the Monday low of 3234.

Meanwhile...

Things aren't improving, as the (official) Corona virus numbers are growing by around 50% per day.

LIVE map: https://gisanddata.maps.arcgis.com/apps/opsdashboard/index.html#/bda7594740fd40299423467b48e9ecf6

For now, the general populace in the western world don't much care. If the current rate of increase holds into the end of next week... they will.

Finally...

A haunting trailer from Netflix. yours, bullish Lynch... until the end

--

--

Extra charts in AH (usually around 5pm EST) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: Permabeardoomster.com

sp'daily5

VIX'daily3

Summary

US equities opened moderately higher, and built significant gains into the afternoon.

Trump had the time in mid morning...

Again, we have the US President calling for lower rates, all that is missing is a request for renewed QE... which of course, we already have.

Ms Yoon of CNBC made another appearance...

So, which is it? Did Eunice run out of masks, consider the threat less problematic than yesterday, or was told to 'lose the mask' by corporate HQ or the local communists?

Volatility was in cooling mode, with the VIX settling -10.7% at 16.28. S/t outlook offers another equity swing lower - once the fed are out of the way, to break under the Monday low of 3234.

Meanwhile...

Things aren't improving, as the (official) Corona virus numbers are growing by around 50% per day.

LIVE map: https://gisanddata.maps.arcgis.com/apps/opsdashboard/index.html#/bda7594740fd40299423467b48e9ecf6

For now, the general populace in the western world don't much care. If the current rate of increase holds into the end of next week... they will.

Finally...

A haunting trailer from Netflix. yours, bullish Lynch... until the end

--

|

| The skies clearing after seven days of grey horror |

|

| Crescent moon and Venus |

|

| Next full moon is Feb'9th |

Extra charts in AH (usually around 5pm EST) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: Permabeardoomster.com

Monday, 27 January 2020

Understandably spooked

US equity indexes closed very significantly lower, sp -51pts (1.6%) at 3243. Nasdaq comp' -1.9%. Dow -1.6%. The Transports settled -2.4%.

sp'daily5

VIX'daily3

Summary

US equities opened very significantly lower, on further adverse Corona virus headlines.

Trump duly posted...

Whilst Yoon of CNBC, decided a mask was necessary...

-

The late morning, and much of the afternoon saw a great of equity chop, but with some renewed weakness into the close.

Volatility naturally spiked, with the VIX see an opening high of 19.02, cooling to the 16s, and settling +25.2% at 18.23. This morning's low of sp'3234 will surely be taken out, whether on Tuesday... or with the FOMC on Wednesday.

Key resource data/map for the Coronavirus:

https://gisanddata.maps.arcgis.com/apps/opsdashboard/index.html#/bda7594740fd40299423467b48e9ecf6

--

Extra charts in AH (usually around 5pm EST) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: Permabeardoomster.com

sp'daily5

VIX'daily3

Summary

US equities opened very significantly lower, on further adverse Corona virus headlines.

Trump duly posted...

Whilst Yoon of CNBC, decided a mask was necessary...

-

The late morning, and much of the afternoon saw a great of equity chop, but with some renewed weakness into the close.

Volatility naturally spiked, with the VIX see an opening high of 19.02, cooling to the 16s, and settling +25.2% at 18.23. This morning's low of sp'3234 will surely be taken out, whether on Tuesday... or with the FOMC on Wednesday.

Key resource data/map for the Coronavirus:

https://gisanddata.maps.arcgis.com/apps/opsdashboard/index.html#/bda7594740fd40299423467b48e9ecf6

--

Extra charts in AH (usually around 5pm EST) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: Permabeardoomster.com

Saturday, 25 January 2020

Weekend update - US equity indexes

It was a bearish week for US equity indexes, with net

weekly declines ranging from -1.9% (Trans), -1.4% (NYSE comp'), -1.2% (Dow), -1.0% (SPX), to -0.8% (Nasdaq comp').

Lets take our regular look at five of the main US indexes

sp'500

A new historic high of 3337.77, but settling net lower for the week by -34pts (1.0%) to 3295.

Nasdaq comp'

A new historic high of 9451, but settling -74pts (0.8%) to 9314.

Dow

The mighty Dow saw a net weekly decline of -358pts (1.2%) to 28989.

NYSE comp'

The master index settled -204pts (1.4%) to 13978.

Trans

The old leader - Transports, settled -219pts (1.9%) to 11059.

–

Summary

All five equity indexes saw net weekly declines.

The Transports lead the way lower, with the Nasdaq most resilient.

The SPX and Nasdaq broke new historic highs.

–

Looking ahead

It will be a very busy week, with a truck load of earnings, and a meeting of the monetary masters of Print Central.

Earnings:

M - DHI, ARNC, JNPR, FFIV

T - MMM, PFE, UTX, LMT, AAPL, AMD, SBUX, XLNX, EBAY

W - BA, GE, MA, T, MCD, MPC, GD, ANTM, TSLA, MSFT, FB, PYPL, LRCX, LVS,

T - UPS, KO, VZ, BIIB, AMZN, V, X, WDC, EA, AMGN

F - XOM, CAT, CVX, HON, PSX

-

Econ-data:

M - New home sales, Dallas Fed' manu'

T - Durable goods orders, Case-Shiller HPI, consumer con', Richmond Fed' manu

W - Intl' trade, pending home sales, EIA Pet'

FOMC 2pm announcement, with a Powell press conf' at 2.30pm. No policy change can be expected. It will be interesting to see if any of the mainstream media hacks question Powell on the REPOs or QE.

T - Q4 GDP (2.1% est'), weekly jobs

F - Pers' income/outlays, employment costs, Chicago PMI, consumer sent'

*As Friday is end month, I would expect higher volume.

-

Final note

We're almost through the first month of the year. Earnings are coming in broadly 'reasonable', as the US economy continues to tick along. The equity market is unquestionably being given an extra kick higher by ongoing QE.

There are three key s/t scenarios...

-The Coronavirus spirals out of control, and the market declines by around 10%. The Fed cut rates, and maintain t-bill buying into the summer.

-The fed end t-bill buying end March, and equities washout back to 3000/2900s, filling most (if not all) of the legacy gaps.

-The printing continues, and the market reaches the 3500/600s by mid year. Even if the fed continue to print, its difficult not to see the market eventually breaking lower. A 20% drop (even if briefly) would seriously spook the mainstream, and Trump's probability of reelection would fall... if only a little.

To be crystal clear, whilst yours truly is seeking a washout to the 3000/2900s, I remain m/t bullish. The fed can be expected to cut rates, and print however much is necessary to prevent the paper bubble from completely bursting.

I say it on an increasingly regular basis, but every day just gets a little bit more crazy, in what is... the twilight zone. If I'm right about anything, you know that much is correct.

If you value my work on Blogger and Twitter, subscribe to my intraday service.

For details/latest offers, see: Permabeardoomster.com

Have a good weekend

--

*the next post on this page will likely appear 5pm EST on Monday.

Lets take our regular look at five of the main US indexes

sp'500

A new historic high of 3337.77, but settling net lower for the week by -34pts (1.0%) to 3295.

Nasdaq comp'

A new historic high of 9451, but settling -74pts (0.8%) to 9314.

Dow

The mighty Dow saw a net weekly decline of -358pts (1.2%) to 28989.

NYSE comp'

The master index settled -204pts (1.4%) to 13978.

Trans

The old leader - Transports, settled -219pts (1.9%) to 11059.

–

Summary

All five equity indexes saw net weekly declines.

The Transports lead the way lower, with the Nasdaq most resilient.

The SPX and Nasdaq broke new historic highs.

–

Looking ahead

It will be a very busy week, with a truck load of earnings, and a meeting of the monetary masters of Print Central.

Earnings:

M - DHI, ARNC, JNPR, FFIV

T - MMM, PFE, UTX, LMT, AAPL, AMD, SBUX, XLNX, EBAY

W - BA, GE, MA, T, MCD, MPC, GD, ANTM, TSLA, MSFT, FB, PYPL, LRCX, LVS,

T - UPS, KO, VZ, BIIB, AMZN, V, X, WDC, EA, AMGN

F - XOM, CAT, CVX, HON, PSX

-

Econ-data:

M - New home sales, Dallas Fed' manu'

T - Durable goods orders, Case-Shiller HPI, consumer con', Richmond Fed' manu

W - Intl' trade, pending home sales, EIA Pet'

FOMC 2pm announcement, with a Powell press conf' at 2.30pm. No policy change can be expected. It will be interesting to see if any of the mainstream media hacks question Powell on the REPOs or QE.

T - Q4 GDP (2.1% est'), weekly jobs

F - Pers' income/outlays, employment costs, Chicago PMI, consumer sent'

*As Friday is end month, I would expect higher volume.

-

Final note

We're almost through the first month of the year. Earnings are coming in broadly 'reasonable', as the US economy continues to tick along. The equity market is unquestionably being given an extra kick higher by ongoing QE.

There are three key s/t scenarios...

-The Coronavirus spirals out of control, and the market declines by around 10%. The Fed cut rates, and maintain t-bill buying into the summer.

-The fed end t-bill buying end March, and equities washout back to 3000/2900s, filling most (if not all) of the legacy gaps.

-The printing continues, and the market reaches the 3500/600s by mid year. Even if the fed continue to print, its difficult not to see the market eventually breaking lower. A 20% drop (even if briefly) would seriously spook the mainstream, and Trump's probability of reelection would fall... if only a little.

To be crystal clear, whilst yours truly is seeking a washout to the 3000/2900s, I remain m/t bullish. The fed can be expected to cut rates, and print however much is necessary to prevent the paper bubble from completely bursting.

I say it on an increasingly regular basis, but every day just gets a little bit more crazy, in what is... the twilight zone. If I'm right about anything, you know that much is correct.

If you value my work on Blogger and Twitter, subscribe to my intraday service.

For details/latest offers, see: Permabeardoomster.com

Have a good weekend

--

*the next post on this page will likely appear 5pm EST on Monday.

Friday, 24 January 2020

Bearish end to a bullish week

US equity indexes closed broadly lower, sp -30pts (0.9%) at 3295. Nasdaq comp' -0.9%. Dow -0.6%. The Transports settled -0.7%.

sp'daily5

VIX'daily3

Summary

US equities opened on a positive note, but the gains were shaky from the very start, with a notable opening black 30/60min equity candle. With further adverse coronavirus headlines, the market turned negative, and price steadily fell into the mid afternoon to 3281. There was a bounce from the typical turn time of 2.30pm, but that still made for a broadly red close.

Volatility opened weak, but swung strongly higher, with the VIX settling +12.2% at 14.56. S/t outlook offers the sp'3260/50s, before a more realistic bounce.

--

Your views...

71% of you have no fear, or are only mildly concerned. For the record, yours truly is only 'fractionally concerned' about the Coronavirus. Across the years, we've seen mainstream hysteria about SARS, Ebola, and a few other such things... none of which has amounted to anything of significance.

Yes... at some point, we're going to have a global pandemic that kills millions, and yes, due to global travel, it will spread faster than anything the world has ever seen. In any case, a number of Chinese cities (16 as of Jan'24th) are partly locked down, as the 'year of the rat' is set to begin on Saturday.

--

Extra charts in AH (usually around 5pm EST) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: Permabeardoomster.com

sp'daily5

VIX'daily3

Summary

US equities opened on a positive note, but the gains were shaky from the very start, with a notable opening black 30/60min equity candle. With further adverse coronavirus headlines, the market turned negative, and price steadily fell into the mid afternoon to 3281. There was a bounce from the typical turn time of 2.30pm, but that still made for a broadly red close.

Volatility opened weak, but swung strongly higher, with the VIX settling +12.2% at 14.56. S/t outlook offers the sp'3260/50s, before a more realistic bounce.

--

Your views...

71% of you have no fear, or are only mildly concerned. For the record, yours truly is only 'fractionally concerned' about the Coronavirus. Across the years, we've seen mainstream hysteria about SARS, Ebola, and a few other such things... none of which has amounted to anything of significance.

Yes... at some point, we're going to have a global pandemic that kills millions, and yes, due to global travel, it will spread faster than anything the world has ever seen. In any case, a number of Chinese cities (16 as of Jan'24th) are partly locked down, as the 'year of the rat' is set to begin on Saturday.

--

Extra charts in AH (usually around 5pm EST) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: Permabeardoomster.com

Thursday, 23 January 2020

Coronavirus concerns

US equity indexes closed rather mixed, sp +3pts (0.1%) at 3325. Nasdaq comp' +0.2%. Dow -0.1%. The Transports settled +1.3%.

sp'daily5

VIX'daily3

Summary

US equities opened moderately weak, pressured via broad declines in Asian markets, as many are increasingly concerned about the Coronavirus. There was a latter day recovery, as the market burnt off s/t cyclical oversold conditions.

Volatility picked up a little, the VIX spiking to 14.15, but settling +0.5% at 12.98.

Its notable that yesterday's black SPX candle played out. Such candles are never to be dismissed lightly. I will merely add, even an (eventual) washout to sp'3K will do nothing to dent the mid/long term trend. Ohh, and such a washout would see Print Central cut rates, something that would please a great many, not least the US President.

--

Extra charts in AH (usually around 5pm EST) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: Permabeardoomster.com

sp'daily5

VIX'daily3

Summary

US equities opened moderately weak, pressured via broad declines in Asian markets, as many are increasingly concerned about the Coronavirus. There was a latter day recovery, as the market burnt off s/t cyclical oversold conditions.

Volatility picked up a little, the VIX spiking to 14.15, but settling +0.5% at 12.98.

Its notable that yesterday's black SPX candle played out. Such candles are never to be dismissed lightly. I will merely add, even an (eventual) washout to sp'3K will do nothing to dent the mid/long term trend. Ohh, and such a washout would see Print Central cut rates, something that would please a great many, not least the US President.

--

Extra charts in AH (usually around 5pm EST) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: Permabeardoomster.com

Wednesday, 22 January 2020

A black candle

US equity indexes mostly closed fractionally higher, sp +1pt at 3321. Nasdaq comp' +0.1%. Dow -0.03%. The Transports settled -0.7%.

sp'daily5

VIX'daily3

Summary

US equities opened moderately higher, and it was enough for the SPX to break a new historic high of 3337.77, making it a day and week for the bulls.

Trump caught some attention in early morning...

Interviewed by the Kernan of CNBC, the US President took a few mild swipes at the fed, and once again called for lower interest rates. For the record, another rate cut looks probable late spring/early summer.

The late afternoon saw a little equity cooling, with the SPX briefly turning fractionally red.

Volatility remained subdued, with the VIX settling +0.5% at 12.91.

The SPX settled with a black candle today, and that does lean s/t bearish. The fact it will be a Thursday, will inherently favour the bears. Things only turn 'interesting' with a break of s/t rising trend, and tomorrow, that will be around 3292.

--

Extra charts in AH (usually around 5pm EST) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: Permabeardoomster.com

sp'daily5

VIX'daily3

Summary

US equities opened moderately higher, and it was enough for the SPX to break a new historic high of 3337.77, making it a day and week for the bulls.

Trump caught some attention in early morning...

Interviewed by the Kernan of CNBC, the US President took a few mild swipes at the fed, and once again called for lower interest rates. For the record, another rate cut looks probable late spring/early summer.

The late afternoon saw a little equity cooling, with the SPX briefly turning fractionally red.

Volatility remained subdued, with the VIX settling +0.5% at 12.91.

The SPX settled with a black candle today, and that does lean s/t bearish. The fact it will be a Thursday, will inherently favour the bears. Things only turn 'interesting' with a break of s/t rising trend, and tomorrow, that will be around 3292.

--

Extra charts in AH (usually around 5pm EST) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: Permabeardoomster.com

Tuesday, 21 January 2020

A little weakness

US equity indexes closed on a weak note, sp -8pts (0.3%) at 3320. Nasdaq comp' -0.2%. Dow -0.5%. The Transports settled -1.8%.

sp'daily5

VIX'daily3

Summary

US equities opened on a moderately weak note, on concerns of the Coronavirus in China. For now, there is little to reason to expect this will develop into anything of significance.

Trump was in Switzerland, at the annual Davos meeting...

.. and he couldn't resist but take a swipe at the fed. Its still kinda amusing, as yours truly is no fan of print central.

The early afternoon saw the SPX come fractionally close to last Friday's historic high, but then taking a moderate swing lower, partly pressured via Boeing. Volatility remained very subdued, with the VIX settling +6.2% at 12.85.

--

--

Extra charts in AH (usually around 5pm EST) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: Permabeardoomster.com

sp'daily5

VIX'daily3

Summary

US equities opened on a moderately weak note, on concerns of the Coronavirus in China. For now, there is little to reason to expect this will develop into anything of significance.

Trump was in Switzerland, at the annual Davos meeting...

.. and he couldn't resist but take a swipe at the fed. Its still kinda amusing, as yours truly is no fan of print central.

The early afternoon saw the SPX come fractionally close to last Friday's historic high, but then taking a moderate swing lower, partly pressured via Boeing. Volatility remained very subdued, with the VIX settling +6.2% at 12.85.

--

|

| Barren winter |

|

| The day is discernibly getting longer |

Extra charts in AH (usually around 5pm EST) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: Permabeardoomster.com

Subscribe to:

Comments (Atom)