It was a broadly bullish month for world equity markets, with net monthly changes ranging from +11.2% (Brazil), +6.8% (Germany), +2.8% (USA - Dow), to -0.3% (Russia). With the US market leading the way higher, along with further central bank 'easy money' policy, the mid term outlook is bullish.

Lets take our monthly look at ten of the world equity markets.

USA - Dow

The mighty Dow climbed for a sixth consecutive month, with a net July gain of 502pts (2.8%), settling at 18432, having broken a new historic high of 18622. This was the first monthly close >18k since Feb'2015.

Underlying MACD (green bar histogram) ticked higher for a sixth month, and is set for a bullish cross at the Aug'1st open. This will be the first positive cycle since Feb'2015.

Upper monthly bollinger will be in the 18700s in August. The 19k threshold looks out of range until at least Sept. Considering there will likely be 1 or 2 moderate multi-week cooling cycles before year end, the giant psy' level of 20k looks out of range until early 2017.

Germany

The economic powerhouse of the EU - Germany, saw a powerful July gain of 6.8%, settling at 10337. Declining trend/resistance is around 10500. Any price action in the 10600s should confirm a push toward 12k by year end, with the April 2015 high of 12390 viable in early 2017. It is notable that for the moment, underlying price momentum remains strongly negative, and a bullish MACD cross is out of range until at least September.

Japan

The BoJ fuelled Japanese Nikkei rebounded by 6.4%, settling at 16569. Mid term trend remains bearish, but will turn provisionally bullish on any move >17500, and decisively bullish with the 18000s. A year end close >20k looks a stretch, even if the BoJ spool up the printers some more into the autumn.

China

China settled higher for a second month, +1.7% @ 2979, notably under the 3K threshold, and the key 10MA (3056). Any price action in the 3100s should confirm a move to 4K, possibly 4400/600 zone by year end, not least if the PBOC increase their meddling.

Brazil

The Brazilian market climbed for a second month, +11.2% @ 57308 - the highest level since May 2015. Declining trend/resistance has been clearly broken and held above. Next upside is the 60K threshold, and then upper declining trend around 62/63k.

Brazil remains a highly problematic nation, remaining in deep recession, and seeing serious geo-political turmoil. The eyes of the world will centre on Brazil next week, as the Olympics are due to begin. Even if the event proceeds without any significant problems, once its over, the Brazilian populace will have to again face the reality of economic and political upset.

Russia

The Russian market saw a third month of relative chop, net lower for July by -0.3% @ 928. The psy' level of 1K remains powerful resistance. With energy prices under renewed downward pressure across July, it was no surprise to see the RTSI lean on the weaker side.

UK

The UK market saw significant bullish follow through from the hyper-reversal in June, settling +3.4% at 6724. Multi-decade resistance remains at the 7K threshold. Any monthly close >7K would bode for far higher levels into spring 2017.

Despite disappointing the market in July, the BoE still look set to cut rates by 25bps to 0.25% in August, and equally likely to spool up the printers again. Carney - and many in UK govt' remain concerned that the economy is highly vulnerable after the decision to exit the EU.

France

The French market managed an impressive net monthly gain of 4.8%, settling at 4439... around declining trend/resistance. Any price action in the 4500s in August should confirm a move to 5K into the autumn. It is highly notable there is VERY powerful declining trend/resistance, that stretches all the way back to Sept'2000. As of late Dec'2016, that will be around 5100.

Spain

The ugliest of the EU PIIGS - Spain, saw a net monthly gain of 5.2%, settling at 8587.. still holding beneath declining trend/resistance. The key 10MA will be around 9K in Aug/Sept. Any price action >9K would bode for yet another attempt to clear massive resistance of 12K by late spring 2017. A monthly close >12K would offer a viable challenge to test the Nov'2007 high of 16040, and right now, that is a massive 87% higher!

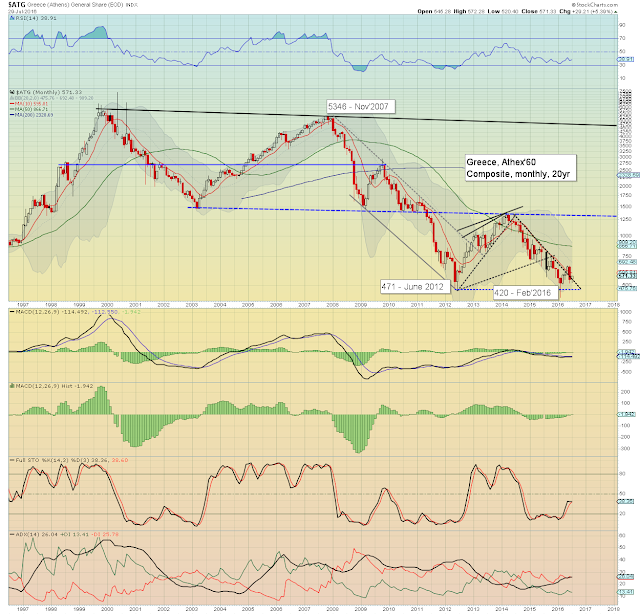

Greece

The economic/societal basket case that is Greece, saw a net July gain of 5.4%, settling at 571. Next upside target are the 650s, with 850/900 viable in early 2017. A break >1300 is extremely difficult, as underlying issues remain entirely unresolved. It should remain clear that the Greek economy will eventually have to break from the Euro currency, and revert to the Drachma. That in itself would be extremely traumatic to the Greek market, although once the dust settles... capital would then start to flood in.

Summary

A broadly bullish month for world equities

The US market is leading the way higher, having broken new historic highs in the Dow and sp'500.

Most markets remain holding within broad downward trends from 2015, although many are close to breaking key aspects of upside resistance - such as Germany, China, and France.

The Jan/Feb' lows are increasingly cemented as key multi-year lows, with broader upside due into spring 2017, and possibly extending into 2018.

Equity bears have nothing to tout unless the June lows are broken under, such as Dow 17063.

--

Looking ahead

There are further earnings due, but broadly, the market will be more focused on the latest monthly jobs data.

M - PMI/ISM manu', construction

T - vehicle sales, pers' income/outlays

W - ADP jobs, PMI, ISM serv', EIA report

T - weekly jobs, factory orders

F - monthly jobs, intl' trade, consumer credit

--

If you have valued my posts across the past four years, subscribe to me, which will give you access to my continuing intraday posts.

Have a good weekend

--

*the next post on this page will appear Monday @ 7pm EST.

Saturday, 30 July 2016

Another month for the equity bulls

US equity indexes closed moderately mixed, sp +3pts @ 2173 (new historic

high 2177). The two leaders - Trans/R2K, settled -0.2% and +0.2%

respectively. VIX settled -6.7% @ 11.87. Near term outlook offers the 2200s in August, with further

upward grind into mid/late September.

sp'daily5

VIX'daily3

Summary

So... the equity bulls even managed a fractional new historic high in the sp' to finish off the month. The US market is unquestionably bullish.. and the outlook is indeed positive for August, and past the Labour day holiday of Sept 5th.

VIX is naturally very subdued, regularly unable to even hold the low teens. With 'Jackson hole' in late August, the VIX will probably get stuck in the mid teens. The key 20 threshold looks out of range until late September.

--

A fifth month for the equity bulls...

sp'monthly

A net July gain of 74pts (3.6%), having broken a new historic high of 2177, and that ain't bearish, is it?

Goodnight from London

--

*The weekend post will appear Sat' 12pm EST, and will detail the world monthly indexes

sp'daily5

VIX'daily3

Summary

So... the equity bulls even managed a fractional new historic high in the sp' to finish off the month. The US market is unquestionably bullish.. and the outlook is indeed positive for August, and past the Labour day holiday of Sept 5th.

VIX is naturally very subdued, regularly unable to even hold the low teens. With 'Jackson hole' in late August, the VIX will probably get stuck in the mid teens. The key 20 threshold looks out of range until late September.

--

A fifth month for the equity bulls...

sp'monthly

A net July gain of 74pts (3.6%), having broken a new historic high of 2177, and that ain't bearish, is it?

Goodnight from London

--

*The weekend post will appear Sat' 12pm EST, and will detail the world monthly indexes

Friday, 29 July 2016

New highs are due

US equity indexes closed moderately mixed, sp +3pts @ 2170 (intra low

2159). The two leaders - Trans/R2K, settled +0.1% and -0.1%

respectively. VIX settled -0.9% @ 12.72. Near term outlook offers a renewed push higher into the

2180/90s.

sp'daily5

VIX'daily3

Summary

Today was day'11 of a trading range that spans just 20pts (2175/55).. a mere 0.9%.

VIX is reflecting a market that is arguably 'consolidating in time', after a post BREXIT hyper ramp from sp'1991 to 2175.

--

Update from Riley

--

Another push higher

With just one trading day left of July, it is now a certainty that the sp'500 will be settling near/at new historic highs. Whether >2175 is exceeded tomorrow or in August... it really makes no difference. Further, it should be clear that broader upside into mid/late September seems highly probable.

The next threat will be a rate hike at the FOMC of Sept'21st, but considering other central banks are set to cut rates/increase QE... Fed tightening remains extremely unlikely.

I can't be bearish unless a monthly close under the monthly 10MA.. and that is currently in the sp'2050s.

Goodnight from London

sp'daily5

VIX'daily3

Summary

Today was day'11 of a trading range that spans just 20pts (2175/55).. a mere 0.9%.

VIX is reflecting a market that is arguably 'consolidating in time', after a post BREXIT hyper ramp from sp'1991 to 2175.

--

Update from Riley

--

Another push higher

With just one trading day left of July, it is now a certainty that the sp'500 will be settling near/at new historic highs. Whether >2175 is exceeded tomorrow or in August... it really makes no difference. Further, it should be clear that broader upside into mid/late September seems highly probable.

The next threat will be a rate hike at the FOMC of Sept'21st, but considering other central banks are set to cut rates/increase QE... Fed tightening remains extremely unlikely.

I can't be bearish unless a monthly close under the monthly 10MA.. and that is currently in the sp'2050s.

Goodnight from London

Thursday, 28 July 2016

No change, no surprise

US equities closed significantly mixed, sp -2pts @ 2166 (intra low

2159). The two leaders - Trans/R2K, settled -1.5% and +0.2%

respectively. VIX settled -1.7% @ 12.83. Near term outlook offers the sp'2180/90s for the July

close.

sp'daily5

VIX'daily3

Summary

So the Fed decided to leave int' rates unchanged in a range of 25/50bps. The next FOMC is not until Sept'21st, and even if the next two sets of monthly jobs data come in good, the Fed will remain reluctant to raise as the BoE, ECB, and even BoJ, might have cut rates.

--

July is set for very significant gains

sp'monthly

The sp' is set for a fifth consecutive net monthly gain, and that is about as bullish as it gets. As of next Monday, we're set for a bullish MACD cross (aka.. MARCON 7), which will officially put the market back into 100% bullish mode.

Yes there are all manner of financial and geo-political 'issues' that could be used to excite the equity bears about possible future declines, but... ongoing price action offers absolutely nothing.

Goodnight from London

sp'daily5

VIX'daily3

Summary

So the Fed decided to leave int' rates unchanged in a range of 25/50bps. The next FOMC is not until Sept'21st, and even if the next two sets of monthly jobs data come in good, the Fed will remain reluctant to raise as the BoE, ECB, and even BoJ, might have cut rates.

--

July is set for very significant gains

sp'monthly

The sp' is set for a fifth consecutive net monthly gain, and that is about as bullish as it gets. As of next Monday, we're set for a bullish MACD cross (aka.. MARCON 7), which will officially put the market back into 100% bullish mode.

Yes there are all manner of financial and geo-political 'issues' that could be used to excite the equity bears about possible future declines, but... ongoing price action offers absolutely nothing.

Goodnight from London

Wednesday, 27 July 2016

Awaiting excuses 447-449

US equities indexes closed moderately mixed, sp +0.7pts @ 2169. The two

leaders - Trans/R2K, settled higher by 1.1% and 0.6% respectively. VIX settled +1.4% @ 13.05. Near

term outlook threatens (at best) a test of the 2130s, but regardless...

the sp'2200s remain due.

sp'daily5

VIX'daily3

Summary

A pretty subdued day in market land. It was notable that the two leaders were pushing higher, with the Transports provisionally confirming price structure of a bull flag.

VIX remains broadly subdued, with the key 20 threshold likely out of range until at least mid/late September.

Cyclically speaking, equity bears could argue for a break lower tomorrow afternoon, and into month end/early August. Yet, the past nine trading days have likely just been 'consolidation across time', before the next push higher in August.

--

WTIC weekly

A fourth consecutive net daily decline, -0.5% @ $42.92. Bearish chatter continues to increase, with talk of the mid $30s. Yet... equity prices are far more suggestive that oil prices will 'somehow' settle the year closer to $60 than $40.. nevermind the $30s.

--

447-449

The FOMC will issue a press release Wed' @ 2pm, there will not be a Yellen press conf'. There is higher probability of a 10km wide asteroid landing in the Pacific ocean tomorrow afternoon than the US fed raising rates.

What will excuses 447, 448, and 449 be, to justifiy not raising rates? I'm sure most of you can think of as many as I can.

As things are, the next realistic chance of the Fed raising rates - by a monstrous 25bps to a target range of 50/75bps, will be the Dec'14 meeting. and that is twenty weeks away. For others - notably UK savers, rates are set to be cut, with business people being issued with threats of possible charges being implemented by year end.

Clearly, the world economy just gets better with each day, and that is why we need rates to remain at emergency levels.

Is it time for the 100 meter hurdles in Rio yet?

Goodnight from London

sp'daily5

VIX'daily3

Summary

A pretty subdued day in market land. It was notable that the two leaders were pushing higher, with the Transports provisionally confirming price structure of a bull flag.

VIX remains broadly subdued, with the key 20 threshold likely out of range until at least mid/late September.

Cyclically speaking, equity bears could argue for a break lower tomorrow afternoon, and into month end/early August. Yet, the past nine trading days have likely just been 'consolidation across time', before the next push higher in August.

--

WTIC weekly

A fourth consecutive net daily decline, -0.5% @ $42.92. Bearish chatter continues to increase, with talk of the mid $30s. Yet... equity prices are far more suggestive that oil prices will 'somehow' settle the year closer to $60 than $40.. nevermind the $30s.

--

447-449

The FOMC will issue a press release Wed' @ 2pm, there will not be a Yellen press conf'. There is higher probability of a 10km wide asteroid landing in the Pacific ocean tomorrow afternoon than the US fed raising rates.

What will excuses 447, 448, and 449 be, to justifiy not raising rates? I'm sure most of you can think of as many as I can.

As things are, the next realistic chance of the Fed raising rates - by a monstrous 25bps to a target range of 50/75bps, will be the Dec'14 meeting. and that is twenty weeks away. For others - notably UK savers, rates are set to be cut, with business people being issued with threats of possible charges being implemented by year end.

Clearly, the world economy just gets better with each day, and that is why we need rates to remain at emergency levels.

Is it time for the 100 meter hurdles in Rio yet?

Goodnight from London

Tuesday, 26 July 2016

Looking ahead to the July close

US equity indexes closed moderately weak, sp -6pts @ 2168. The two

leaders - Trans/R2K, settled lower by -0.9% and -0.2% respectively. VIX settled +7.1% @ 12.87. Near

term outlook still threatens an 'FOMC mini washout' to the breakout

level of the sp'2130s, but broadly... the 2200s look inevitable.

sp'daily5

VIX'daily3

Summary

So, some weakness to begin the last week of July, but still, it was nothing of any significance.

It is notable that we've traded in a mere 20pt (0.9%) range across the past 8 days. Its arguably just 'consolidation in time', before the next push into the 2200s.

VIX remains broadly subdued

--

Looking ahead to the July close

There are still four trading days left of July, but my attention is already switching to how the monthly candles will settle. As things are, a July close above the monthly 10MA (currently 2056) is now a certainty, and it is extremely probable that the sp'500 will settle net higher for a fifth consecutive month - the best run since June 2014.

My home market of the UK will be making a serious play for the 7000s this Aug/September...

A monthly close >7K would be hugely significant, and bode for similar strength in the US. The BoE will likely cut rates by 25bps in August, and possibly even spool up the printers. UK savers will once again be (justifiably) dismayed with the Canadian.... Mr Carney.

*I'll cover the world markets in depth this coming weekend.

Goodnight from London

sp'daily5

VIX'daily3

Summary

So, some weakness to begin the last week of July, but still, it was nothing of any significance.

It is notable that we've traded in a mere 20pt (0.9%) range across the past 8 days. Its arguably just 'consolidation in time', before the next push into the 2200s.

VIX remains broadly subdued

--

Looking ahead to the July close

There are still four trading days left of July, but my attention is already switching to how the monthly candles will settle. As things are, a July close above the monthly 10MA (currently 2056) is now a certainty, and it is extremely probable that the sp'500 will settle net higher for a fifth consecutive month - the best run since June 2014.

My home market of the UK will be making a serious play for the 7000s this Aug/September...

A monthly close >7K would be hugely significant, and bode for similar strength in the US. The BoE will likely cut rates by 25bps in August, and possibly even spool up the printers. UK savers will once again be (justifiably) dismayed with the Canadian.... Mr Carney.

*I'll cover the world markets in depth this coming weekend.

Goodnight from London

Saturday, 23 July 2016

Weekend update - US weekly indexes

It was a fourth consecutive bullish week for most US equity indexes, with net weekly changes ranging from +1.4% (Nasdaq comp'), +0.6% (sp'500, R2K), to -0.2% (Transports). Regardless of any near term cooling, further broad upside looks due across August and into September.

Lets take our regular look at six of the main US indexes

sp'500

A net weekly gain of 13pts (0.6%), with a new historic high of 2175. Underlying MACD (blue bar histogram) cycle ticked higher for a fourth week. Upper bollinger is 2159, and the weekly close was the first above/outside the upper bollinger since June 2014.

Best guess: a little chop ahead of the FOMC, but then climbing into end month, although the 2200s look more viable in early August. The 2225/50 zone is highly probable into early September.

As of end August, rising trend - from the Feb' low of 1810, will be around 2080. Equity bears can't have any hope unless a monthly close in the 2070s.

Nasdaq comp'

The tech' lead the way higher this week, with a net gain of 70pts (1.4%) at 5100, a mere 132pts (2.6%) shy of the July 2015 high. Any weekly close in the 5300s will open the door wide to the 6000s by late spring 2017.

Dow

The mighty Dow managed a net gain of 0.3%, settling at 18570, which is 3200pts (20.8%) above the Aug'2015 low. With a new historic high of 18622, the door is open to next resistance in the 18700/900s. Any price action >19k should confirm the psy' level of 20K is viable before year end.

For those who believe in giant multi-year waves and aspects of fibonacci, starting from March'2009, if the 19000s are seen, next key fib/price target would be 25/26k. That looks an extreme stretch by late spring 2017, but will be well within range in 2018.

Old resistance of 18k is now first support, and by mid September, rising support will also be around 18k.

--

NYSE comp'

The master index gained 0.3%, settling @ 10805. 11K is next target/resistance, and looks due in Aug/September. After that, the May 2015 high of 11254. A year end close around 12K is just about within range.

R2K

The second market leader - R2K, gained 0.6%, settling at 1212, the best level since Aug'2015. Next level is the June 2015 high of 1296, which is around 7% higher.

Trans

The 'old leader' - Trans, was the notable exception this week, with a minor net decline of -0.2%. 8K remains pretty strong resistance, although the tranny still looks set to climb with the rest of the market. Next upside target are the 8300/400s. The Nov' 2014 historic high of 9310 is still a very considerable 16.9% higher.

--

Summary

Broadly, US equities continue to climb from their post BREXIT lows.

The sp'500 and Dow are leading the way higher, with the Nasdaq set to follow with a new historic high in Aug/September. At the current rate, the R2K/Trans are still 3-6 months away from having realistic opportunity of new historic highs.

Equities could decline around 3% in Aug'/early Sept', and that would not do any damage to the mid term bullish trend.

--

The final big fifth

A reminder on what remains one of the more valid scenarios...

sp'monthly1c

Having decisively broken above the summer 2015 high, it can be argued that price action since Jan/Feb is part of a final fifth wave. Time is as much an issue as price. Continued upside into spring 2017 looks probable, and based on wave'1, a more extended move all the way into spring 2018 is possible.

The next fib' extrapolation (2.618x) - from the March'2009 low, is sp'3047. For now, that can understandably be seen as 'crazy talk', but then... so was 2K as recently as summer 2013.

I could quite prefer a move to around 3K, as a 50% 'bear market' decline would then offer a back test of the 2000/2007 double top in the sp'1500s. Anyway, its just one scenario of many, and I'll detail it some more another time.

--

Looking ahead

Along with further corp' earnings, there is a fair amount of important econ-data.

M -

T - Case-shiller HPI, PMI serv', New home sales, consumer con', richmond fed'

W - Durable goods, Pending home sales, EIA oil report

The FOMC are set to announce at 2pm, there will not be a press' conf.

T - weekly jobs, intl' trade

F - GDP (Q2, first est'),- market is expecting 2.6%, which does seem overly optimistic. Employment costs, Chicago PMI, consumer sent'

The week is light on Fed officials, with just Williams/Kaplan on Friday. I would imagine Yellen will be busy working on 'Reasons not to raise rates - excuses 451-455', for the autumnal FOMC meetings.

--

If you have valued my posts across the past four years, you can support me via a monthly subscription, which will give you access to my continuing intraday posts.

Have a good weekend

--

*the next post on this page will appear Monday @ 7pm EST.

Lets take our regular look at six of the main US indexes

sp'500

A net weekly gain of 13pts (0.6%), with a new historic high of 2175. Underlying MACD (blue bar histogram) cycle ticked higher for a fourth week. Upper bollinger is 2159, and the weekly close was the first above/outside the upper bollinger since June 2014.

Best guess: a little chop ahead of the FOMC, but then climbing into end month, although the 2200s look more viable in early August. The 2225/50 zone is highly probable into early September.

As of end August, rising trend - from the Feb' low of 1810, will be around 2080. Equity bears can't have any hope unless a monthly close in the 2070s.

Nasdaq comp'

The tech' lead the way higher this week, with a net gain of 70pts (1.4%) at 5100, a mere 132pts (2.6%) shy of the July 2015 high. Any weekly close in the 5300s will open the door wide to the 6000s by late spring 2017.

Dow

The mighty Dow managed a net gain of 0.3%, settling at 18570, which is 3200pts (20.8%) above the Aug'2015 low. With a new historic high of 18622, the door is open to next resistance in the 18700/900s. Any price action >19k should confirm the psy' level of 20K is viable before year end.

For those who believe in giant multi-year waves and aspects of fibonacci, starting from March'2009, if the 19000s are seen, next key fib/price target would be 25/26k. That looks an extreme stretch by late spring 2017, but will be well within range in 2018.

Old resistance of 18k is now first support, and by mid September, rising support will also be around 18k.

--

NYSE comp'

The master index gained 0.3%, settling @ 10805. 11K is next target/resistance, and looks due in Aug/September. After that, the May 2015 high of 11254. A year end close around 12K is just about within range.

R2K

The second market leader - R2K, gained 0.6%, settling at 1212, the best level since Aug'2015. Next level is the June 2015 high of 1296, which is around 7% higher.

Trans

The 'old leader' - Trans, was the notable exception this week, with a minor net decline of -0.2%. 8K remains pretty strong resistance, although the tranny still looks set to climb with the rest of the market. Next upside target are the 8300/400s. The Nov' 2014 historic high of 9310 is still a very considerable 16.9% higher.

--

Summary

Broadly, US equities continue to climb from their post BREXIT lows.

The sp'500 and Dow are leading the way higher, with the Nasdaq set to follow with a new historic high in Aug/September. At the current rate, the R2K/Trans are still 3-6 months away from having realistic opportunity of new historic highs.

Equities could decline around 3% in Aug'/early Sept', and that would not do any damage to the mid term bullish trend.

--

The final big fifth

A reminder on what remains one of the more valid scenarios...

sp'monthly1c

Having decisively broken above the summer 2015 high, it can be argued that price action since Jan/Feb is part of a final fifth wave. Time is as much an issue as price. Continued upside into spring 2017 looks probable, and based on wave'1, a more extended move all the way into spring 2018 is possible.

The next fib' extrapolation (2.618x) - from the March'2009 low, is sp'3047. For now, that can understandably be seen as 'crazy talk', but then... so was 2K as recently as summer 2013.

I could quite prefer a move to around 3K, as a 50% 'bear market' decline would then offer a back test of the 2000/2007 double top in the sp'1500s. Anyway, its just one scenario of many, and I'll detail it some more another time.

--

Looking ahead

Along with further corp' earnings, there is a fair amount of important econ-data.

M -

T - Case-shiller HPI, PMI serv', New home sales, consumer con', richmond fed'

W - Durable goods, Pending home sales, EIA oil report

The FOMC are set to announce at 2pm, there will not be a press' conf.

T - weekly jobs, intl' trade

F - GDP (Q2, first est'),- market is expecting 2.6%, which does seem overly optimistic. Employment costs, Chicago PMI, consumer sent'

The week is light on Fed officials, with just Williams/Kaplan on Friday. I would imagine Yellen will be busy working on 'Reasons not to raise rates - excuses 451-455', for the autumnal FOMC meetings.

--

If you have valued my posts across the past four years, you can support me via a monthly subscription, which will give you access to my continuing intraday posts.

Have a good weekend

--

*the next post on this page will appear Monday @ 7pm EST.

A fourth week of gains

US equity indexes ended the week on a positive note, sp +9pts @ 2175.

The two leaders - Trans/R2K, settled higher by 1.4% and 0.7%

respectively. VIX settled -5.6% @ 12.02. Near term outlook offers minor threat of FOMC cooling to

the 2130s, but broader upside across August and into September.

sp'daily5

VIX'daily3

Summary

So, despite yet another Friday 'event' in mainland Europe, the sp'500 ended the week at the historic high of 2175.

VIX was naturally back in cooling mode, settling sub-teens for the ninth consecutive day. The key 20 threshold looks out of range until mid/late September.

--

WTIC oil, weekly

A significant net weekly decline of -$2.09 (4.5%), settling @ $44.19. Clearly, the psy' level of $50 is natural resistance. It could be argued price structure is offering a large multi-month bull flag, that would be provisionally confirmed with a weekly close >$48.

The weakness in oil is not particularly surprising considering the continuing strength in the USD. There will be some significant downward pressure in Oil, Gold/Silver, and even equities, on a break >DXY 100.

USD, weekly

The US Fed will certainly not wish to see the USD break above DXY 100, and will thus be highly inclined against raising rates - which would make the USD even more attractive. Price action/structure since early 2015 could be argued is a giant multi-year bull flag. A break >100 would offer an eventual move to the 120s, which would likely equate to USD>GBP parity.

Goodnight from London

---

*the weekend post on the US weekly indexes will appear Sat' @ 12pm EST

sp'daily5

VIX'daily3

Summary

So, despite yet another Friday 'event' in mainland Europe, the sp'500 ended the week at the historic high of 2175.

VIX was naturally back in cooling mode, settling sub-teens for the ninth consecutive day. The key 20 threshold looks out of range until mid/late September.

--

WTIC oil, weekly

A significant net weekly decline of -$2.09 (4.5%), settling @ $44.19. Clearly, the psy' level of $50 is natural resistance. It could be argued price structure is offering a large multi-month bull flag, that would be provisionally confirmed with a weekly close >$48.

The weakness in oil is not particularly surprising considering the continuing strength in the USD. There will be some significant downward pressure in Oil, Gold/Silver, and even equities, on a break >DXY 100.

USD, weekly

The US Fed will certainly not wish to see the USD break above DXY 100, and will thus be highly inclined against raising rates - which would make the USD even more attractive. Price action/structure since early 2015 could be argued is a giant multi-year bull flag. A break >100 would offer an eventual move to the 120s, which would likely equate to USD>GBP parity.

Goodnight from London

---

*the weekend post on the US weekly indexes will appear Sat' @ 12pm EST

Friday, 22 July 2016

A retrace to the breakout zone?

US equities closed moderately weak, sp -7pts @ 2165. The two leaders -

Trans/R2K, settled lower by -1.3% and -0.5% respectively. VIX settled +8.2% @ 12.74. Near term

outlook offers a retrace to the breakout zone of the sp'2130s, but

broadly, price action remains very bullish.

sp'daily5

VIX'daily3

Summary

So, moderate declines, and frankly, nothing for the equity bears to get excited about. Even a move to the sp'2130s next week would merely make for a minor retrace, before the 2200s.

VIX failed to close in the low teens for a sixth consecutive day, which kinda sums up just how strong/confident the US market is. The key 20 threshold looks out of range until at least mid/late September.

--

Notable world market - UK, monthly

A July close >7k looks out of range, but by Sept/Oct, it looks viable. A break/hold >7K would be extremely bullish, and bode for broader upside to the 8000s in early 2017. Most other world markets look similarly bullish.

--

Regardless of any further cooling tomorrow/early next week, the underlying upward pressure should be clear to almost everyone.

I'm well aware of some out there touting a return to the sp'1800s by the early autumn, yet... how is that going to occur? Even the 'shock' BREXIT result only resulted in a two day decline.. and the second day even saw the VIX close red!

Last Monday's breakout >sp'2134 remains a hugely significant event, and the 2200s look an easy target for Aug/September.

Goodnight from London

sp'daily5

VIX'daily3

Summary

So, moderate declines, and frankly, nothing for the equity bears to get excited about. Even a move to the sp'2130s next week would merely make for a minor retrace, before the 2200s.

VIX failed to close in the low teens for a sixth consecutive day, which kinda sums up just how strong/confident the US market is. The key 20 threshold looks out of range until at least mid/late September.

--

Notable world market - UK, monthly

A July close >7k looks out of range, but by Sept/Oct, it looks viable. A break/hold >7K would be extremely bullish, and bode for broader upside to the 8000s in early 2017. Most other world markets look similarly bullish.

--

Regardless of any further cooling tomorrow/early next week, the underlying upward pressure should be clear to almost everyone.

I'm well aware of some out there touting a return to the sp'1800s by the early autumn, yet... how is that going to occur? Even the 'shock' BREXIT result only resulted in a two day decline.. and the second day even saw the VIX close red!

Last Monday's breakout >sp'2134 remains a hugely significant event, and the 2200s look an easy target for Aug/September.

Goodnight from London

Thursday, 21 July 2016

Blue skies for the equity bulls

US equities closed moderately higher, sp +9pts @ 2173 (intra high 2175).

The two leaders - Trans/R2K, settled u/c and +0.8% respectively. VIX settled -1.7% @ 11.77. Near

term outlook still threatens a minor retrace to the breakout level of

the 2130s, but broadly... the 2200s look an easy target for August.

sp'daily

VIX, monthly

Summary

Another day for the equity bulls, as the sp' breaks a new high of 2175, along with Dow 18622.

VIX remains utterly crushed, today's close of 11.77 was the lowest since 26th August 2014.

--

Blue skies for the equity bulls

With another pair of historic index highs, the bulls have justification to be very confident for the rest of the summer. Regardless of the threat of a minor retrace to the breakout level of the sp'2130s, the 2200s look an easy target for August.

I realise some out there are still holding short, the obvious question is... why? The May 2015 high of sp'2134 was always the ultimate line in the sand. That has been decisively broken through, and today marks the eighth consecutive day above the old high.

Sure, we can't keep rising at the current post BREXIT rate (184pts, 9.2%, across 17 trading days) forever, but it should be clear, this is no market for the bears.

Goodnight from London

sp'daily

VIX, monthly

Summary

Another day for the equity bulls, as the sp' breaks a new high of 2175, along with Dow 18622.

VIX remains utterly crushed, today's close of 11.77 was the lowest since 26th August 2014.

--

Blue skies for the equity bulls

With another pair of historic index highs, the bulls have justification to be very confident for the rest of the summer. Regardless of the threat of a minor retrace to the breakout level of the sp'2130s, the 2200s look an easy target for August.

I realise some out there are still holding short, the obvious question is... why? The May 2015 high of sp'2134 was always the ultimate line in the sand. That has been decisively broken through, and today marks the eighth consecutive day above the old high.

Sure, we can't keep rising at the current post BREXIT rate (184pts, 9.2%, across 17 trading days) forever, but it should be clear, this is no market for the bears.

Goodnight from London

Wednesday, 20 July 2016

Quiet day in market land

US equities closed moderately weak, sp -3pts @ 2163. The two leaders -

Trans/R2K, settled lower by -0.1% and -0.6% respectively. VIX settled -3.8% @ 11.97. Near term

outlook threatens a retrace to the breakout zone of 2135/00. The 2100

threshold looks increasingly out of range.

sp'daily5

VIX'daily3

Summary

A fourth consecutive day of minor chop for US equities, arguably in consolidation mode, after the powerful run from the BREXIT low of sp'1991.

With Microsoft (MSFT) earnings coming in much better than expected, the VIX fell into the 11s in the brief 15 minutes of AH trading, which made for the lowest close since July 17th 2015.

-

King Dollar remains... King

USD, weekly

Today's close in the DXY 97s was overlooked by many, but I sure noticed. The 97s open the door to further grind higher to the 98/99s.

A break above the 100 threshold would be massively significant, and as many recognise, would have all sorts of consequences, particularly for commodities.

Why is the USD rising? Mostly capital flows into the US, from almost every part of the world. A secondary issue is that much foreign debt is denominated in USD, and that underpins a strong USD bid.

Goodnight from London

sp'daily5

VIX'daily3

Summary

A fourth consecutive day of minor chop for US equities, arguably in consolidation mode, after the powerful run from the BREXIT low of sp'1991.

With Microsoft (MSFT) earnings coming in much better than expected, the VIX fell into the 11s in the brief 15 minutes of AH trading, which made for the lowest close since July 17th 2015.

-

King Dollar remains... King

USD, weekly

Today's close in the DXY 97s was overlooked by many, but I sure noticed. The 97s open the door to further grind higher to the 98/99s.

A break above the 100 threshold would be massively significant, and as many recognise, would have all sorts of consequences, particularly for commodities.

Why is the USD rising? Mostly capital flows into the US, from almost every part of the world. A secondary issue is that much foreign debt is denominated in USD, and that underpins a strong USD bid.

Goodnight from London

Tuesday, 19 July 2016

Underlying upward pressure

US equities started the week on a moderately positive note, sp +5pts @

2166. The two leaders - Trans/R2K, settled -0.1% and +0.2% respectively.

The VIX settled -1.8% @ 12.44. Near term outlook threatens a minor retrace to the breakout zone of

2135/30, but broadly.. the 2200s look a given.

sp'daily

VIX'daily

Summary

Relative to the recent (and ongoing) geo-political/societal unrest, the US/world equity markets are holding up very well. The US market is leading the world on a new multi-month upswing.. and that looks set to continue across the summer.

--

With just 9 trading days left of the month, the equity bulls are set to see most (if not all) US indexes close higher for a fifth consecutive month.

sp'monthly

With the break above the May 2015 high of 2134, we are very close to a bullish MACD cross, which would take us positive cycle for the first time since Jan'2015. As ever, the monthly close will be important.

Goodnight from London

--

sp'daily

VIX'daily

Summary

Relative to the recent (and ongoing) geo-political/societal unrest, the US/world equity markets are holding up very well. The US market is leading the world on a new multi-month upswing.. and that looks set to continue across the summer.

--

With just 9 trading days left of the month, the equity bulls are set to see most (if not all) US indexes close higher for a fifth consecutive month.

sp'monthly

With the break above the May 2015 high of 2134, we are very close to a bullish MACD cross, which would take us positive cycle for the first time since Jan'2015. As ever, the monthly close will be important.

Goodnight from London

--

Subscribe to:

Comments (Atom)