It was a bearish week for US equity indexes,

with net weekly declines ranging from -4.4%

(Trans), -2.6% (R2K), -1.6% (NYSE comp'), -1.3% (sp'500), -1.2% (Dow), to

-0.8% (Nasdaq comp').

Lets take our regular look at six of the main US indexes (weekly candle charts)

sp'500

The sp'500 fell for a second consecutive week, the fourth week of five, with a net decline of -33pts (1.3%) to settle at 2599. MACD (blue bar histogram) cycle continues to increasingly favour the bears. It can be argued we're cyclically very low, but that has been the case since late October.

A formal test of the Feb' low of 2532 appears a given, whether before the FOMC, or shortly after. Any daily close <2532 will offer grander downside to the 2300/250 zone. The bigger monthly charts suggest the latter zone will be seen no later than late Jan/early Feb, which is a seasonally weak time.

--

Nasdaq comp'

Tech was the most resilient index this week, seeing just a moderate decline of 0.8% to 6910. Further cooling to the Feb' low of 6630 appears highly probable. A daily close under 6630 will offer grander downside to giant psy'5K.

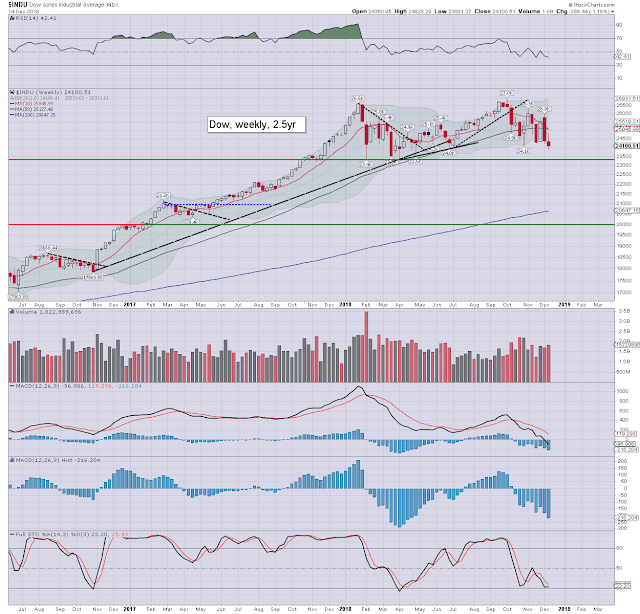

Dow

The mighty Dow settled -1.2% to 24100. The April low of 23344 appears set to be tested. A failure to hold will offer grander target of 21k, with secondary support of the 20400/20k zone.

NYSE comp'

The master index settled -1.6% to 11755, the lowest weekly settlement since Aug'2017. Next support is the May 2015 high of 11254.

R2K

The R2K settled -2.6% to 1410, which made for decisive close under the Feb' low. Next support around 1350, which is another 4% lower.

Trans

The 'old leader' continues to lead the way lower, settling -4.4% at 9514. Last week's bearish engulfing candle was indeed a warning of trouble, as the tranny is back to levels last seen in Nov'2017. Next support is around 9k, with secondary of the 8700s.

–

Summary

All six indexes closed net lower for the week.

The Transports is leading the way lower, whilst the Nasdaq was resilient.

With the Trans, R2K, and NYSE comp' having decisively taken out their Feb' lows, the Sp'500, Dow, and Nasdaq comp' can be expected to follow.

YTD price performance:

The Nasdaq comp' is the lone index net higher for the year, and only by a fractional 0.1%. The Dow is -2.5%, with the spx -2.8%. The R2K is -8.1%, NYSE comp' -8.2%, with the Transports -10.3%

--

Looking ahead

*It will be the last 5 day trading week until the week of Jan'7-11

**there are just 9.5 trading days left of the year

Key earnings: ORCL (Mon'), MU, FDX (Tue'), NKE (Thurs')

M - Empire state, housing market index

T - Housing starts

W - Existing home sales, EIA Pet' report.

FOMC announcement (2pm), which will (very likely) detail the ninth rate hike since Dec'2015, of +25bps to a new target range of 2.25-2.50%. There will be a press conf' at 2.30pm.

T - Weekly jobs, phil' fed, leading indicators

F - Durable goods orders, Q3 GDP (3rd print), pers' income/outlays, consumer sent'. *OPEX*

--

Final note

Whilst the US econ-data is still coming in broadly fine, its increasingly problematic in other parts of the world. In particular, the EU appears close, if not already in recession. When the Q4 GDP print for Germany appears in mid/late January, it will likely also be negative, making Germany officially in recession. Where Germany goes, the rest of Europe can be expected to follow.

There is the recent break in the US bond market. If the US 10yr does cool to natural target of 2.25%, it will result in far higher bond prices, which will have bearish implications for equities.

Whilst many within the mainstream are still seeing the ongoing equity cooling - since the Sept'21st high of sp'2940.91, as just a mid term correction, it increasingly appears to be the start of something bigger.

--

If you value my work on Blogger and Twitter, subscribe to me.

For details:

https://permabeardoomster.blogspot.co.uk/p/subscriptions.html

Have a good weekend

--

*the next post on this page will likely appear 5pm EST on Monday.