US equities remain a little choppy, with the s/t cyclical setup leaning weak into the close. Due in AH, earnings from AXP, which should help to keep everyone awake... not least yours truly. VIX is battling to avoid a seventh consecutive net daily decline. Oil has seen a renewed push upward, +3.1% in the mid $68s.

sp'60min

VIX'60min

Summary

The hourly equity cycle is offering a bearish macd cross into the close, which does lean to the equity bears. Note the lower hourly bollinger at 2666, and that will offer big support in the 2680/70s tomorrow.

--

notable stock: AXP ,daily

American Express has earnings in AH, and they should be good, but far superior alts are MA and V, whose profit margins are massively better by 5-6x.

--

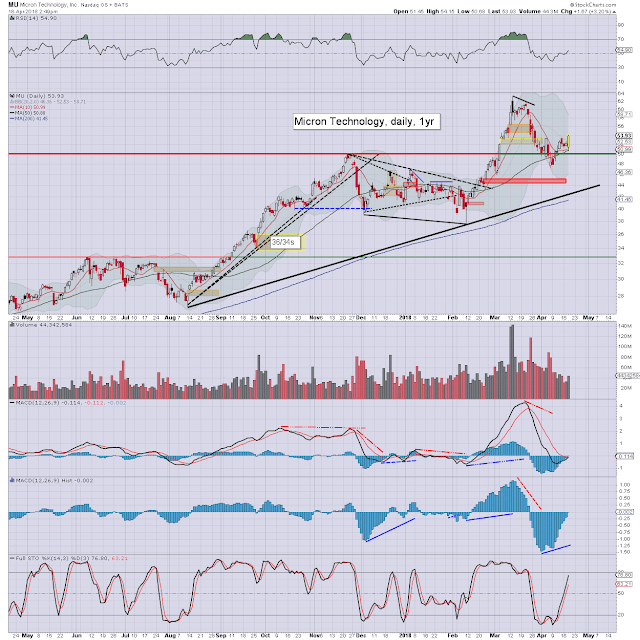

notable strength: MU, daily

After an early morning smack down (for no good reason, other than LRCX weakness), Micron is set for sig' net daily gains.

--

weakness, IBM, daily

An ugly post earnings sell down in IBM, which we've seen in a very select set of stocks so far this earnings season. Underlying valuation remains cheap, but INTC, CSCO, MU... far superior.

--

strength, BABA, daily

As there is increasing mainstream attention in this one. Notable call activity in the May 195/200s today.

back at the close...