It was a bearish week for US equity indexes,

with net weekly declines ranging from -0.5%

(NYSE comp'), -0.6% (sp'500, Nasdaq comp'), to

-1.2% (R2K). Near term outlook offers a bounce of around 1.5%, but if the market can't achieve at least a couple of new historic highs by mid September... it would be a serious issue.

Lets take our regular look at six of the main US indexes

sp'500

The sp' settled net lower for a second consecutive week, -15pts (0.6%) at 2425. Short term rising trend from mid May has been broken. Underlying MACD (blue bar histogram) cycle continues to tick lower, as price momentum increasingly favours the equity bears.

Best guess: a near term bounce to at least 2462/68. A daily close >2474 will offer new historic highs to the low 2500s in September. A 5% retrace looks very probable within the late Sept/early Oct' period. The year end target of 2683 remains on track.

Equity bears have nothing to tout unless a break under 2360/50, where the monthly 10MA, 200dma, and rising trend - from Feb'2016, all intersect. Keep in mind, those numbers are rising with each month.

--

Nasdaq comp'

The tech settled lower for a fourth consecutive week, -0.6% at 6216, the most bearish run since May 2016. Price momentum moderately leans to the bears, and in theory, could tick lower for another 2-3 weeks. There is huge support within the 6000/5900 zone. It will be important for the equity bulls to break >6460 in the next multi-week up cycle within Sept/Oct. A lower high around 6300, with a new low under first rising support (<6100) would be a serious problem.

Dow

The mighty Dow settled lower for a second week, -0.8% at 21674. A bounce to the 22000 threshold is highly probable within the very near term. A marginally lower high (<22179) would be a problem for the equity bulls. First soft support is the rising 10MA - in the 21600s, then core rising support in the 20900s, rising to 21k in early September. Any price action <20900 would offer a test of the giant 20k threshold by early October.

NYSE comp'

The master index settled lower for a second week, -0.5% at 11699. Core rising trend - from Feb'2016, has been fractionally broken under. Next support is not until around 11400... almost 3% lower, which would arguably equate to sp'2360/50.

R2K

The second market leader - R2K, is still leading the way lower, settling lower for a fourth consecutive week, -1.2% at 1357. Its notable that from the recent historic high of 1452, the R2K has declined by a rather significant 6.5%. Underlying MACD is now on the rather low side, with a probable bounce to attempt to re-take the 1400 threshold. A key lower high would be a serious problem, and threaten basic downside to the 1300/1280 zone.

Trans

The 'old leader' - Transports, settled lower for the fourth week of the past five, -1.1% at 9095. There is natural psy' level support around 9k, but the weekly close under the 200dma (9190) is rather bearish. This week's candle is a clear spike fail against the key 10MA. It strongly suggest that the 9400s are now strong resistance, and will restrain any bounces into end August/early September.

Any break <9k would offer basic downside to the 8700s. In early October, rising trend will be around 8800. Any price action in the 8700s would merit alarm bells, and threaten a crash wave to around 7000 (sp'500 equivalent: 1900) - which is a powerful 23% below current levels.

--

Summary

2 of the 6 indexes - R2K and NYSE comp' have settled below key rising support - that stretches back to early 2016.

It remains notable that recent cooling remains relatively moderate, with the sp'2490>20 wave amounting to just 2.8%.

All six indexes recently broke new historic highs, which is very bullish on any basis.

--

Keeping things in perspective

First, consider... sp'monthly1b

I recognise some prefer the 13MA, but regardless, the point is... the mid/long term trend remains outright bullish. For now, other than day/swing trading shorts, there is no reason to be strategically bearish on a mid term basis.

Things only get interesting with a break AND monthly close under 2360/50. That range/threshold is climbing with each month of course.

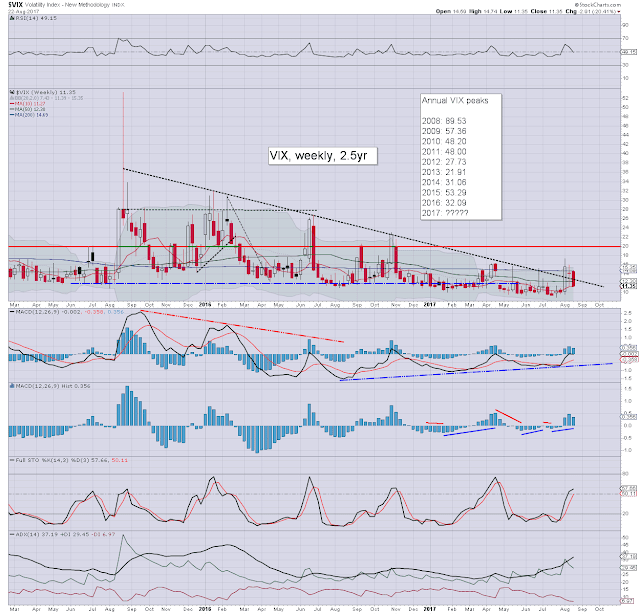

Second... VIX'weekly

Last week saw the VIX decisively break AND settle above declining trend. The series of lower highs from Aug'2015 has concluded. Any price action above last Friday's (pre-market) high of 17.28 would merit alarm bells, and offer an initial jump to the key 20 threshold, and then possibly much higher.

So, for now, there is still no real reason to be particularly bearish. The VIX is offering a hint of 'something' this Sept/Oct, but equities are still broadly strong, and close to recent historic highs. If you want that kind of perspective during the market day, then subscribe!

--

Looking ahead

In terms of earnings and econ-data, there is very little, and it will likely be the quietest week since early July.

Jackson Hole: there will be a meeting of economists, central bankers, and other miscellaneous lunatics, beginning on Thursday, and stretching into the weekend. Yellen is scheduled to speak Friday morning at 10am, and that will no doubt garner major media coverage.

M -

T - House price index, Richmond Fed manu'

W - New home sales, EIA Pet' report

T - Weekly jobs, existing home sales

F - Durable goods orders, Jackson Hole: Yellen (10am)

--

Extra charts @

https://twitter.com/permabear_uk

--

If you value my work, subscribe to me. For $20pcm, I typically provide

500 charts, 40,000 words across 200 posts each and every month.

For details:

https://permabeardoomster.blogspot.co.uk/p/subscriptions.html

Have a good weekend

--

*the next post on this page will likely appear 6pm EST on Monday.