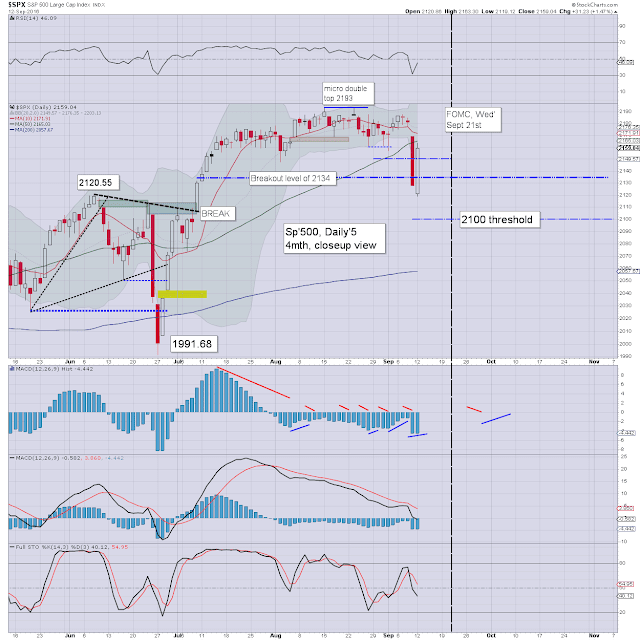

sp'daily5

VIX'daily3

Summary

For anyone watching pre-market, there were already a few signs that the equity bears were in trouble. One that stood out to me was seeing pre-market VIX +10%... yet the 2x lev' bullish instrument of TVIX was only +1%.

The opening equity declines sure didn't last long, and we saw a classic opening reversal, with gains building across the day. Considering the severity of the Friday declines, it was surprising to see how the market managed to keep pushing upward... rather than get stuck around natural fib' retraces of 2142 or 50.

Clearly, price action is likely to remain somewhat choppy ahead of next Wednesday's FOMC. Once that is out of the way though, things should resume broadly higher.

--

Fed/market chatter from Schiff

--

On clown finance TV this lunchtime, Johnson of Piper Jaffray was resolutely holding to a year end target of sp'2350

Frankly... I'm in agreement. The 2300s are well within range, not least as Q3 earnings should at least be 'reasonable'.

As I will keeping say.... things will only turn broadly bearish if we're trading below the monthly 10MA (along with a few other related aspects of support). Right now, unless we see the sp'2050s or lower, equity bears have little to be confident about.

Goodnight from London