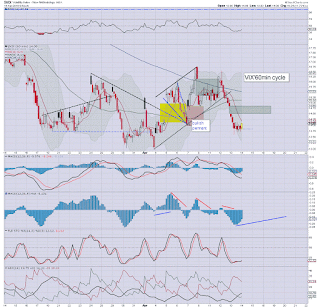

With US equity indexes breaking new cycle highs (sp'2087), the VIX saw an intra low of 13.38, and settled -0.9% @ 13.72. Near term outlook offers the sp'2065/61 gap zone, which would likely equate to VIX 15s. Any daily closes <sp'2050 look difficult.

VIX'60min

VIX'daily3

Summary

Suffice to add.. the VIX remains broadly subdued, as the US/world capital markets are increasingly confident that 'everything is fine again'.

The key 20 threshold looks out of range until at least early May. By default, that would like push any opportunity of the 30/40s until June.

--

more later... on the indexes

Thursday, 14 April 2016

Closing Brief

US equities closed moderately mixed, sp +0.3pts @ 2082 (intra high 2087). The two leaders - Trans/R2K, settled +0.2% and -0.1% respectively. Near term outlook offers cooling to the 2065/61 gap zone. Any price action <2050 looks difficult, as the market is increasingly confident that 'normal service' has fully resumed.

sp'60min

Summary

*closing hour action: micro chop, leaning a touch weak.

--

... another day where the market ground out another tranche of equity bears... with a new multi-month high of sp'2087.. a level most (myself included) thought out of range a mere month ago.

To have any confidence.. equity bears need a daily close <2050 next week. From there... 2020/10s - with VIX 17/18s, but that really looks a tough challenge,

*once opex is out of the way.. there will be ten trading days left of the month.

--

more later... on the VIX

sp'60min

Summary

*closing hour action: micro chop, leaning a touch weak.

--

... another day where the market ground out another tranche of equity bears... with a new multi-month high of sp'2087.. a level most (myself included) thought out of range a mere month ago.

To have any confidence.. equity bears need a daily close <2050 next week. From there... 2020/10s - with VIX 17/18s, but that really looks a tough challenge,

*once opex is out of the way.. there will be ten trading days left of the month.

--

more later... on the VIX

3pm update - cyclically cooling

Having made a new cycle high of sp'2087, equities are set to lean a little lower into the close. Cyclically, a cooling phase is due - at least to the 2065/61 gap zone. With China GDP/production data due overnight, some of the bull maniacs might understandably be a little twitchy about holding.

sp'60min

VIX'60min

Summary

Well, another day.. another new set of cycle highs.

Regardless of the exact close.. a day for the bull maniacs.

Now its a case of whether China can spoil the bulls party.. and begin some weakness that carries across into next week.

--

notable weakness: STX -19.8% in the low $27s.. as the buyers are not interested... the 22/20 zone looks probable.

--

back at the close.

sp'60min

VIX'60min

Summary

Well, another day.. another new set of cycle highs.

Regardless of the exact close.. a day for the bull maniacs.

Now its a case of whether China can spoil the bulls party.. and begin some weakness that carries across into next week.

--

notable weakness: STX -19.8% in the low $27s.. as the buyers are not interested... the 22/20 zone looks probable.

--

back at the close.

2pm update - more debt will help?

US equities remain in minor chop mode, having made fractional new highs of sp'2087 and Dow 17962. The hourly cycles continue to swing back toward the bears, but it remains the case that even a retrace to 2050 will merely make for another higher low.

sp'60min

VIX'60min

Summary

*current hourly candle is somewhat interesting. At the current rate, we'll see a bearish MACD cross early tomorrow.

--

There is clear gap zone to hit first.. its possible before the weekend, but the probability will be far higher after opex.

--

Meanwhile... PYPL are again trying to entice me...

Thanks for the offer Paypal... but no.

Maybe I should instead write to Draghi, and ask for a €1bn loan at -0.5% interest? I'd have an annual income of €5 million, never mind the original €1bn.

yours.. debt free.

-

PYPL, daily

As for the stock, its basically traded within a 25% range since it was spun off from EBAY almost a full year ago, and is following the broader market. I actually quite like the company (along with EBAY), but not at these levels.

-

back at 3pm

sp'60min

VIX'60min

Summary

*current hourly candle is somewhat interesting. At the current rate, we'll see a bearish MACD cross early tomorrow.

--

There is clear gap zone to hit first.. its possible before the weekend, but the probability will be far higher after opex.

--

Meanwhile... PYPL are again trying to entice me...

Thanks for the offer Paypal... but no.

Maybe I should instead write to Draghi, and ask for a €1bn loan at -0.5% interest? I'd have an annual income of €5 million, never mind the original €1bn.

yours.. debt free.

-

PYPL, daily

As for the stock, its basically traded within a 25% range since it was spun off from EBAY almost a full year ago, and is following the broader market. I actually quite like the company (along with EBAY), but not at these levels.

-

back at 3pm

1pm update - the eco system

US equities remain in minor chop mode, having broken fractional new cycle highs of sp'2086 and Dow 17953... the latter of which is very close to breaking the key Nov' high (17977). VIX remains subdued, -2% in the mid 13s.

Dow' daily

VIX'daily3

Summary

Little to add, as the algo-bots continue to melt the market higher.

---

It has long riled me whenever I hear any of the cheerleaders (not least the infamous Cramer) talk about the AAPL or GPRO 'eco system'.

Using such terms is pure marketing nonsense....

GPRO, daily

So.. 3 of the lunch time crew still have GPRO on sell. Does J' Najerian not realise that consumers are no longer in the mood to pay $400 for a HD cam, when they can buy any of a dozen other brands for $40 ?

In terms of price, I guess you could argue GPRO is trying to form a floor, but just consider its basically flat lined as the market has climbed around 15%. I'd not buy it at $1.00, nevermind the teens.

In any case.. every time a cheerleader talks about 'the eco system', an angel loses their wings.

-

back at 2pm

Dow' daily

VIX'daily3

Summary

Little to add, as the algo-bots continue to melt the market higher.

---

It has long riled me whenever I hear any of the cheerleaders (not least the infamous Cramer) talk about the AAPL or GPRO 'eco system'.

Using such terms is pure marketing nonsense....

GPRO, daily

So.. 3 of the lunch time crew still have GPRO on sell. Does J' Najerian not realise that consumers are no longer in the mood to pay $400 for a HD cam, when they can buy any of a dozen other brands for $40 ?

In terms of price, I guess you could argue GPRO is trying to form a floor, but just consider its basically flat lined as the market has climbed around 15%. I'd not buy it at $1.00, nevermind the teens.

In any case.. every time a cheerleader talks about 'the eco system', an angel loses their wings.

-

back at 2pm

12pm update - rainbow before the storm

US equities remain in minor chop mode, and other than the pure cyclical issue that we're due at least a minor cooling phase, there appears little to motivate the market for the rest of today. With the USD +0.2% in the DXY 94.90s, the metals are under pressure, Gold -$15, with Silver -0.8%. Oil +1.0% in the $41s.

sp'60min

GLD, daily

Summary

The new fractional high of sp'2085, is a mere 49pts (2.4%) from the May'2015 high.

So... which is it.. a huge massive bullish breakout, or an epic fail? I suppose you could argue we'll just see continued swings - much like 2015, but the bigger monthly cycles would argue its something far more dynamic.

--

Here in London city...

Awaiting some storms to arrive from France, although a few domestic ones have already developed. There is even some kind of rainbow (which is unusual considering how high the sun is), but where is the unicorn?

-

time to cook

sp'60min

GLD, daily

Summary

The new fractional high of sp'2085, is a mere 49pts (2.4%) from the May'2015 high.

So... which is it.. a huge massive bullish breakout, or an epic fail? I suppose you could argue we'll just see continued swings - much like 2015, but the bigger monthly cycles would argue its something far more dynamic.

--

Here in London city...

Awaiting some storms to arrive from France, although a few domestic ones have already developed. There is even some kind of rainbow (which is unusual considering how high the sun is), but where is the unicorn?

-

time to cook

11am update - the chop continues

Have ramped from sp'2039 (when the latest oil story broke), the market is in minor chop mode. Even if (and its a big if) the market is upset at latest China GDP number, a move to 2050 will not break trend, and will merely make for a higher low. VIX remains is reflecting this, breaking a new cycle low of 13.53.

sp'60min

VIX'60min

Summary

Its getting real tedious again.

There really isn't anything to motivate the market until the overnight China GDP number.

Yes.. the hourly cycle is STILL swinging back toward the bears.. but with opex tomorrow... the inclination will be for just more chop.. rather than for any notable declines.

--

notable weakness, STX, -19% in the $27s. Its really not hard to imagine the 22/20 zone... if the main market cools just to sp'2K.. nevermind anything actually significant.

--

time for some sun... before the storms arrive.

sp'60min

VIX'60min

Summary

Its getting real tedious again.

There really isn't anything to motivate the market until the overnight China GDP number.

Yes.. the hourly cycle is STILL swinging back toward the bears.. but with opex tomorrow... the inclination will be for just more chop.. rather than for any notable declines.

--

notable weakness, STX, -19% in the $27s. Its really not hard to imagine the 22/20 zone... if the main market cools just to sp'2K.. nevermind anything actually significant.

--

time for some sun... before the storms arrive.

10am update - opening minor chop

US equity indexes open with very minor chop. Price momentum on the hourly cycle is naturally swinging back toward the bears, and there will be increasing downward pressure into this afternoon. However, even if sp'2050 is hit Fri/Monday, that will merely make for yet another higher low.

sp'60min

VIX'60min

Summary

So... a pretty subdued open, but there is a slight tendency for the market to cool.. especially late this afternoon.

*China GDP is due overnight.. hard to guess how the market might react to that... even if I knew the number in advance.

--

notable weakness... STX, daily

An ugly open.. but then the profits warning was nasty. As noted earlier, perhaps the CEO of what is a superb tech company, should merely ramp up the share buy back? That will solve ALL the problems, yes?

In terms of price, if the Jan' low of $25s fail to hold (which seems probable).. next support is not until the $22/20 zone, which is a further 20% lower.

yours... running on STX drives.

sp'60min

VIX'60min

Summary

So... a pretty subdued open, but there is a slight tendency for the market to cool.. especially late this afternoon.

*China GDP is due overnight.. hard to guess how the market might react to that... even if I knew the number in advance.

--

notable weakness... STX, daily

An ugly open.. but then the profits warning was nasty. As noted earlier, perhaps the CEO of what is a superb tech company, should merely ramp up the share buy back? That will solve ALL the problems, yes?

In terms of price, if the Jan' low of $25s fail to hold (which seems probable).. next support is not until the $22/20 zone, which is a further 20% lower.

yours... running on STX drives.

Pre-Market Brief

Good morning. US equity futures are essentially flat, we're set to open at sp'2082. USD is +0.2% in the DXY 94.90s. Metals remain a little weak, Gold -$3, with Silver -0.6%. Oil is +0.5% in the $41s.

sp'60min

Summary

*awaiting CPI data, and weekly jobs.

--

Overnight futures were moderately lower overnight, but as the USD cooled from some gains, and as Oil recovered.. hence.. we're back to flat.

Considering opex is tomorrow, the next cooling phase will likely not be until after the weekend.

--

early mover: Seagate (STX) -9%, after a profits warning.

Maybe they just need to increase the stock buyback, that will solve the revenue and profitability problems, yes?

--

Update from Mr C.

--

Overnight action

Japan: +3.2% @ 16911

China: +0.5% @ 3082

Germany: currently +0.2% @ 10042

How those indexes settle April will be pretty damn important. Equity bears should be seeking <18000, <3100, and <10300, respectively.

-

Have a good Thursday

sp'60min

Summary

*awaiting CPI data, and weekly jobs.

--

Overnight futures were moderately lower overnight, but as the USD cooled from some gains, and as Oil recovered.. hence.. we're back to flat.

Considering opex is tomorrow, the next cooling phase will likely not be until after the weekend.

--

early mover: Seagate (STX) -9%, after a profits warning.

Maybe they just need to increase the stock buyback, that will solve the revenue and profitability problems, yes?

--

Update from Mr C.

--

Overnight action

Japan: +3.2% @ 16911

China: +0.5% @ 3082

Germany: currently +0.2% @ 10042

How those indexes settle April will be pretty damn important. Equity bears should be seeking <18000, <3100, and <10300, respectively.

-

Have a good Thursday

Not many levels left to break

With a second consecutive day of broad gains, the sp'500 broke a new multi-month high of 2083. Next key levels are the psy' level of 2100, the Nov' high of 2116... and the last line in the sand, the May'2015 historic high of 2134.

sp'weekly1b

sp'monthly1b

Summary

Without getting lost amongst the minor noise, the equity bears should be increasingly desperate for an April close under the monthly 10MA - currently @ 2021.

Considering the next minor cooling phase next week will probably go no lower than 2050... just how are the bears going to be able to re-take control?

The market seemingly doesn't much care about earnings, or that recent US/world econ-data remains relatively weak. Indeed, with JPM announcing an increased stock buyback this morning, we're almost back to 'normal service'.

--

I'm aware a fair few of you do actively follow Oscar 'stops are in, emotions are out' Carboni.

sp'weekly8e - the 'failed head test'.

Technically. so long as the sp'500 holds under the Nov' high of 2116, the scenario is still valid.

--

Looking ahead

Thursday will see the usual weekly jobs and the latest CPI.

*fed officials Powell and Lockhart will be on the loose in early morning.

--

Goodnight from London

sp'weekly1b

sp'monthly1b

Summary

Without getting lost amongst the minor noise, the equity bears should be increasingly desperate for an April close under the monthly 10MA - currently @ 2021.

Considering the next minor cooling phase next week will probably go no lower than 2050... just how are the bears going to be able to re-take control?

The market seemingly doesn't much care about earnings, or that recent US/world econ-data remains relatively weak. Indeed, with JPM announcing an increased stock buyback this morning, we're almost back to 'normal service'.

--

I'm aware a fair few of you do actively follow Oscar 'stops are in, emotions are out' Carboni.

sp'weekly8e - the 'failed head test'.

Technically. so long as the sp'500 holds under the Nov' high of 2116, the scenario is still valid.

--

Looking ahead

Thursday will see the usual weekly jobs and the latest CPI.

*fed officials Powell and Lockhart will be on the loose in early morning.

--

Goodnight from London

Daily Index Cycle update

US equity indexes closed broadly higher for the second consecutive day,

sp +20pts @ 2082 (new multi-month high 2083). The two leaders -

Trans/R2K, settled higher by 2.6% and 2.2% respectively. Near term

outlook offers continued upside melt.. not least with a looming Friday

opex.

sp'daily

Nasdaq

R2K

Summary

sp'500: a clear break above the late Dec' high of 2081. Next upside resistance is arguably not until the psy' level of 2100.

Nasdaq: a strong close above the 4900 threshold. Next resistance is the upper end of the gap at the giant psy' level of 5K.

R2K: settling just under the 200dma. Any daily closes in the 1140s will open up the 1200 threshold.. and that would be suggestive the Dow/Sp'500 would be trading at new historic highs in May.

--

a little more later...

sp'daily

Nasdaq

R2K

Summary

sp'500: a clear break above the late Dec' high of 2081. Next upside resistance is arguably not until the psy' level of 2100.

Nasdaq: a strong close above the 4900 threshold. Next resistance is the upper end of the gap at the giant psy' level of 5K.

R2K: settling just under the 200dma. Any daily closes in the 1140s will open up the 1200 threshold.. and that would be suggestive the Dow/Sp'500 would be trading at new historic highs in May.

--

a little more later...

Subscribe to:

Comments (Atom)