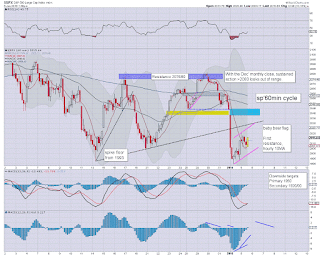

US equities remain moderately mixed, but leaning on the bullish side. A daily close in the sp'2022/27 zone looks probable, and that might be enough to cool the VIX back to the 18s. Price structure remains a clear bear flag, with renewed downside due to begin tomorrow. The sp'1950s look a very reasonable target.

sp'60min

Summary

Its not bold to assume given another 2 hrs... we'll be in the 2020s.. and settle there.

No doubt that will open the door to the 2030s.. even 40s tomorrow.

In either case.. I'm merely seeing it as an opportunity to short... having seen Dec' close bearish across the US and most other world markets.

After all, unless you think we're going to power upward.. beyond resistance of 2070/80s... it is merely a situation of shorting the rallies.

--

notable weakness....

DIS, monthly,

I added a temporary fib chart onto the monthly cycle. A fair retrace of the hyper-ramp from 2009 offers the $80/75 zone. That would be suggestive of sp'1600s or so.

... something to consider for a little while.