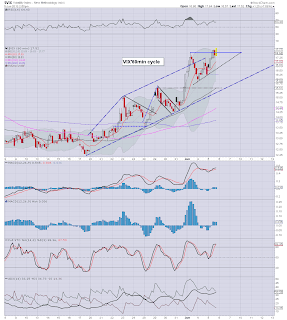

With equities seeing weakness across the day, the VIX managed to hold moderate gains into the close, +7.6% @ 17.50. The big issue remains, can the VIX break into the 20s, for the first time this year?

VIX'60min

VIX'daily3

Summary

The VIX closed near the high of the day, so equity bulls should be still be concerned about how we might be trading Thursday.

Yet, in the bigger picture, we're now overdue a VIX down cycle. Right now, I don't expect much VIX downside tomorrow, the first likely opportunity is probably this Friday, when we have key monthly jobs data.

I still think sp'1600/1597 will hold as a short term key low, and that should then offer a 1-2 week up cycle, somewhere to around sp'1660/70 - perhaps putting in a key lower high.

more later..on those bearish indexes

Wednesday, 5 June 2013

Closing Brief

The main indexes closed lower for a second consecutive day, with most indexes falling around 1.4%. The sp' close of 1608 was a major victory for the bears, but hourly charts are offering at least some degree of bounce across the next two days. VIX confirmed a slightly more concerned market.

sp'60min

Summary

So...a down day, and we closed a mere 8pts from the bears primary target zone of 1600/1597.

All things considered, we'll see a major multi-day bounce starting real soon. Hourly charts are warning of possible upside late tomorrow/early Friday.

--

For those on the short side, congrats, but bears beware...the monthly jobs data is out on Friday, and that could easily be the excuse Mr Market wants to launch another rally.

sp'60min

Summary

So...a down day, and we closed a mere 8pts from the bears primary target zone of 1600/1597.

All things considered, we'll see a major multi-day bounce starting real soon. Hourly charts are warning of possible upside late tomorrow/early Friday.

--

For those on the short side, congrats, but bears beware...the monthly jobs data is out on Friday, and that could easily be the excuse Mr Market wants to launch another rally.

3pm update - battle into the close

A new low for the indexes, and bears are within range of the big sp'1600 target. Its not necessary for that to be hit of course. VIX is higher, but only by 7%, which in the scheme of things, really isn't that much. Most important issue of the day - transports fails to hold the 6200s.

sp'60min

vix'60min

Summary

Well, its the closing hour. Can the bears hit 1600, or will be the bulls manage to kick things higher?

Bulls should be seeking a close >1625. That IS viable, but it'll take a major short-stop cascade to do it.

--

I remain on the wrong train though The irony of it.

--

UPDATE 3.33pm market trying to floor in the 1610/12 area, hourly index charts offering upside into tomorrow. Daily charts STILL bearish though.

sp'60min

I'm still holding out, I guess you could say. Although being a permabear, 'holding out' is not exactly something I'm new to.

sp'60min

vix'60min

Summary

Well, its the closing hour. Can the bears hit 1600, or will be the bulls manage to kick things higher?

Bulls should be seeking a close >1625. That IS viable, but it'll take a major short-stop cascade to do it.

--

I remain on the wrong train though The irony of it.

--

UPDATE 3.33pm market trying to floor in the 1610/12 area, hourly index charts offering upside into tomorrow. Daily charts STILL bearish though.

sp'60min

I'm still holding out, I guess you could say. Although being a permabear, 'holding out' is not exactly something I'm new to.

2pm update - finally, a turn?

Hourly index charts are offering a turn/floor. Clearly, one up candle does not make a trend, and the bulls should be seeking at least sp'>1625 by the close. VIX is also offering a turn, and if the bull maniacs can manage a ramp into the close, a red VIX would again be kinda interesting.

sp'60min

vix'60min

Summary

So, those dip buying bulls (inc' yours truly) have been a bit rattled today, but we're still holding above the key level of 1600.

More than anything...

Today's action is arguably VERY important in the bigger picture. It looks now pretty difficult for the market to break another new high in this current multi-month up cycle - from the Nov' lows.

So..look for a lower high on the next 5-10 day up cycle - into June opex, sometime around then.

*first key downside would be the rising lower bol' on the weekly charts, currently in the 1470s, but 1550s by late July.

sp'60min

vix'60min

Summary

So, those dip buying bulls (inc' yours truly) have been a bit rattled today, but we're still holding above the key level of 1600.

More than anything...

Today's action is arguably VERY important in the bigger picture. It looks now pretty difficult for the market to break another new high in this current multi-month up cycle - from the Nov' lows.

So..look for a lower high on the next 5-10 day up cycle - into June opex, sometime around then.

*first key downside would be the rising lower bol' on the weekly charts, currently in the 1470s, but 1550s by late July.

1pm update - still on the slide

The bears are fully in control, and look set for their primary target of 1600/1597. VIX fails to hold the double top, and the big question is now whether the 20s are viable in the current down cycle - we're at day'10, and still counting.

sp'60min

vix'60min

Summary

Suffice to say, bears are seeing some significant falls again, and there is absolutely no sign of it ending.

No doubt, the talk will now switch to 'if Japan -15%, why not US too ?'

--

1.28pm.. bulls attempting (again) another rebound. As noted earlier, bulls should be seeking the 1630s..but that is indeed a long ways up.

sp'60min

vix'60min

Summary

Suffice to say, bears are seeing some significant falls again, and there is absolutely no sign of it ending.

No doubt, the talk will now switch to 'if Japan -15%, why not US too ?'

--

1.28pm.. bulls attempting (again) another rebound. As noted earlier, bulls should be seeking the 1630s..but that is indeed a long ways up.

12pm update - double top on the VIX

We have a possible short term double top on the VIX. It is suggestive of a latter day equity recovery/bounce, but still, bulls need a close back in the sp'1630s to have any hope of higher levels into the Friday close.

vix'60min

sp'60min

Summary

Well, the sp'1622 floor failed to hold, and understandably, the bears are now seeking 1600/1597 within the next few days.

The bigger daily charts are still bearish, and baring a positive close today - which seems VERY unlikely, the bears look set to hit their target.

-

Best guess right now...'some' degree of bounce into the late afternoon, but it will probably just put in another lower high.

-

*I have to say, I think its more comfortable losing money on the short side, whilst the market is ramping. Urghh.

--

VIX update.. from Mr P.

time for lunch

vix'60min

sp'60min

Summary

Well, the sp'1622 floor failed to hold, and understandably, the bears are now seeking 1600/1597 within the next few days.

The bigger daily charts are still bearish, and baring a positive close today - which seems VERY unlikely, the bears look set to hit their target.

-

Best guess right now...'some' degree of bounce into the late afternoon, but it will probably just put in another lower high.

-

*I have to say, I think its more comfortable losing money on the short side, whilst the market is ramping. Urghh.

--

VIX update.. from Mr P.

time for lunch

11am update - messy market morning

Some minor technical damage has been done this morning. Its nothing critical yet, but still, the Transports broke into the 6100s, and sp' to 1618 - 4pts under the Monday low. VIX is higher, but so far..only 5%, and still below the Monday high.

sp'15min

vix'60min

Summary

Well, with the econ-data failing to inspire the market higher, we're seeing another set of lower highs..and lower lows.

The obvious target - as just about recognises, is sp'1600/1597 gap-fill zone. Thats just over 1% lower, so is viable at any point, even today.

It is increasingly looking like market is not going to be able to break the 1687 high.

--

*I am still long, and obviously..underwater. Right now, I'd settle for an exit in the high 1630s, but that is starting to look a long way up. Urghh

--

Transports, weekly

As you can see, that is now a clear trend break, from the November lows. It is HIGHLY suggestive the top is in on this multi-month wave.

That doesn't mean we won't bounce across the next 3-5 days, but it surely means we won't be putting in any new highs..aka, sp>1687.

11.29am... market again trying to floor, but really struggling. Even a 10pt bounce would do nothing for the bulls today.

Bears are..surprisingly looking in control...obvious target remains 1600.

11.43am..possible double top on the VIX...at least in the immediate term. Even so bulls need VIX in the low 15s to have any confidence of higher levels into the Friday close.

sp'15min

vix'60min

Summary

Well, with the econ-data failing to inspire the market higher, we're seeing another set of lower highs..and lower lows.

The obvious target - as just about recognises, is sp'1600/1597 gap-fill zone. Thats just over 1% lower, so is viable at any point, even today.

It is increasingly looking like market is not going to be able to break the 1687 high.

--

*I am still long, and obviously..underwater. Right now, I'd settle for an exit in the high 1630s, but that is starting to look a long way up. Urghh

--

Transports, weekly

As you can see, that is now a clear trend break, from the November lows. It is HIGHLY suggestive the top is in on this multi-month wave.

That doesn't mean we won't bounce across the next 3-5 days, but it surely means we won't be putting in any new highs..aka, sp>1687.

11.29am... market again trying to floor, but really struggling. Even a 10pt bounce would do nothing for the bulls today.

Bears are..surprisingly looking in control...obvious target remains 1600.

11.43am..possible double top on the VIX...at least in the immediate term. Even so bulls need VIX in the low 15s to have any confidence of higher levels into the Friday close.

10am update - bulls still have the edge

It looks like Mr Market has again teased the bears, and we're seeing an opening floor spike on the 15/60min cycle charts. If the floor holds, then bulls have a real chance at the mid 1640s later today, and that will open up 1655/60 by the end of the week.

sp'15min

sp'60min

vix'60min

Summary

It sure looks like a floor spike to me.

..and we have a black candle on the VIX. Another sign the bulls might be able to whack this market up this morning.

--

*I remain holding heavy long, seeking the sp'1650s, although frankly, I'd be bailing anywhere in the low 1640s later today, if I can get it.

UPDATE 10.04am.. ISM data comes in okay...but factory orders a touch light.

Market still holding the recent floor, but it sure is a borderline situation.

Considering the MACD cycles on the 15/60min cycles, I still think bulls are going to ramp this higher.

--

video from Mr Permabull....

stay tuned

10.19am...well, there goes the 1622 floor. Bulls now in major trouble of another 20pts of downside. I suppose it could be a fake-out, but its effectively pointless to even dare think that.

--

10.33am...bulls attempting a ramp, but really, until we break >1630...bulls remain in serious trouble.

Even more important, bulls need to break 1635, to stabilise things.

One consolation to the bulls...VIX has so far put in a LOWER high.. but that is very unreliable right now. Will only know later in the day, if its important...

Difficult morning though.

sp'15min

sp'60min

vix'60min

Summary

It sure looks like a floor spike to me.

..and we have a black candle on the VIX. Another sign the bulls might be able to whack this market up this morning.

--

*I remain holding heavy long, seeking the sp'1650s, although frankly, I'd be bailing anywhere in the low 1640s later today, if I can get it.

UPDATE 10.04am.. ISM data comes in okay...but factory orders a touch light.

Market still holding the recent floor, but it sure is a borderline situation.

Considering the MACD cycles on the 15/60min cycles, I still think bulls are going to ramp this higher.

--

video from Mr Permabull....

stay tuned

10.19am...well, there goes the 1622 floor. Bulls now in major trouble of another 20pts of downside. I suppose it could be a fake-out, but its effectively pointless to even dare think that.

--

10.33am...bulls attempting a ramp, but really, until we break >1630...bulls remain in serious trouble.

Even more important, bulls need to break 1635, to stabilise things.

One consolation to the bulls...VIX has so far put in a LOWER high.. but that is very unreliable right now. Will only know later in the day, if its important...

Difficult morning though.

Pre-Market Brief

Good morning. Futures are sp -4pts, we're set to open around 1628, a mere 6pts above the key low. Equity bulls have a real problem if the market breaks 1622, that opens a further fall down to 1600/1597 gap zone. USD is lower, with metals and Oil moderately higher.

sp'60min

vix'60min

Summary

Well, this is not the type of open the bulls were looking for. We are going to open real close to key support, and it sure won't take much to break it.

ADP jobs data came in significantly lower than expected, 135k vs 171 exp.

There is an array of other data due this morning, so, market will plenty of reason to move.

--

*I am heavy long, and seeking an exit in the sp'1650s, but that sure looks off the table for today. In fact, even a close in the 1640s now looks difficult.

As it is, the hourly index/VIX charts do suggest the bulls still have the upper hand, but they need to clear the triangle resistance, which by the end of today will be @ 1640.

A long day ahead.

-

sp'60min

vix'60min

Summary

Well, this is not the type of open the bulls were looking for. We are going to open real close to key support, and it sure won't take much to break it.

ADP jobs data came in significantly lower than expected, 135k vs 171 exp.

There is an array of other data due this morning, so, market will plenty of reason to move.

--

*I am heavy long, and seeking an exit in the sp'1650s, but that sure looks off the table for today. In fact, even a close in the 1640s now looks difficult.

As it is, the hourly index/VIX charts do suggest the bulls still have the upper hand, but they need to clear the triangle resistance, which by the end of today will be @ 1640.

A long day ahead.

-

Awaiting another wave higher

The main indexes closed lower by 0.5%, but bulls managed to achieve a marginally higher low. If the sp' can break >1645 this Wednesday (a mere 0.9% higher), then the door is open to the 1650/60s, and then the 1700s will be within easy reach by the latter part of June.

sp'60min

sp'daily5

sp'weekly

Summary

We saw some good volatility again in the market today. Surely the day-traders - those few 'real people' who are left, had some good price action to try and capture?

I expected an intra-day pull back, and indeed it looked as though sp'1634 was the low, but no...Mr Market whacked the market another micro-wave lower, and came within a point of taking out the Monday low.

Had that low failed to hold, we'd probably be looking at the sp'1600s tomorrow.

-

Yet..it did hold, and baring some bizarre overnight gap down, the market looks set for much higher levels tomorrow. The hourly index charts are offering a good 4-6 hours on the upside, and that should at least offer the chance of sp'1645, if not the mid 1650s.

The fact the VIX put in a marginally lower high, is further good support for the near term bullish outlook.

Whether we can break above the Bernanke 'reversal day' high of sp'1687, that is another matter entirely. Right now, that is too hard to guess. Lets first see if we can trade into the 1650s, and if Mr Market can achieve a daily close at that level.

Looking ahead

We have ADP jobs data in pre-market, so look for the market to ramp on that. There is also ISM, factory orders, productivity/costs, and the EIA oil report. Further, there is the Fed Beige book at 2pm. That will be plenty enough for the market to deal with.

--

*I am heavy long, seeking an exit in the sp'1650s.

Goodnight from London

sp'60min

sp'daily5

sp'weekly

Summary

We saw some good volatility again in the market today. Surely the day-traders - those few 'real people' who are left, had some good price action to try and capture?

I expected an intra-day pull back, and indeed it looked as though sp'1634 was the low, but no...Mr Market whacked the market another micro-wave lower, and came within a point of taking out the Monday low.

Had that low failed to hold, we'd probably be looking at the sp'1600s tomorrow.

-

Yet..it did hold, and baring some bizarre overnight gap down, the market looks set for much higher levels tomorrow. The hourly index charts are offering a good 4-6 hours on the upside, and that should at least offer the chance of sp'1645, if not the mid 1650s.

The fact the VIX put in a marginally lower high, is further good support for the near term bullish outlook.

Whether we can break above the Bernanke 'reversal day' high of sp'1687, that is another matter entirely. Right now, that is too hard to guess. Lets first see if we can trade into the 1650s, and if Mr Market can achieve a daily close at that level.

Looking ahead

We have ADP jobs data in pre-market, so look for the market to ramp on that. There is also ISM, factory orders, productivity/costs, and the EIA oil report. Further, there is the Fed Beige book at 2pm. That will be plenty enough for the market to deal with.

--

*I am heavy long, seeking an exit in the sp'1650s.

Goodnight from London

Daily Index Cycle update

The main indexes saw some general weakness as the day progressed, and the sp' came within a point of taking out the Monday low. Yet, the market did put in what is probably an important 'marginally higher low', and that sets up much higher levels. First target is the sp'1650/55 zone.

sp'daily5

Trans

Summary

A pretty interesting day to be part of...and trade.

The bulls managed to kick the market back up from the danger zone in the closing 90 minutes. The close of sp'1631 is certainly not a 'great victory' for those on the long side, but it is a good 8pts above the daily low.

Transports saw a similar fall of 0.5%, and again its important to note, the tranny is still able to hold the important 6200s, closing @ 6257.

--

Bulls should be keep in mind, if the bears can somehow overnight gap the market <1620, Transports will likely lose the 6200s, and that has rather big implications for the mid-term outlook. As ever, one day at a time.

Considering the hourly index charts though, and the marginally higher low, I'm guessing the market has a very reasonable chance of breaking into the important sp'1650s by late tomorrow/early Thursday.

a little more later

sp'daily5

Trans

Summary

A pretty interesting day to be part of...and trade.

The bulls managed to kick the market back up from the danger zone in the closing 90 minutes. The close of sp'1631 is certainly not a 'great victory' for those on the long side, but it is a good 8pts above the daily low.

Transports saw a similar fall of 0.5%, and again its important to note, the tranny is still able to hold the important 6200s, closing @ 6257.

--

Bulls should be keep in mind, if the bears can somehow overnight gap the market <1620, Transports will likely lose the 6200s, and that has rather big implications for the mid-term outlook. As ever, one day at a time.

Considering the hourly index charts though, and the marginally higher low, I'm guessing the market has a very reasonable chance of breaking into the important sp'1650s by late tomorrow/early Thursday.

a little more later

Subscribe to:

Posts (Atom)