With the main indexes continuing to melt higher, the VIX is back on the slide again, closing -1.9% @ 13.31. Even the VIX 14 seems a difficult barrier to break. There remains potential for a brief spike to 15/16, but 18s now seem out of range..for some months.

VIX'60min

VIX'daily

Summary

Another day of painful - and utterly mind numbing, algo-bot melt.

It was no surprise to see the VIX slip lower, and its almost a wonder that we're not already trading in the 11s..or even 10s.

The upper bollinger band - see daily chart, is still collapsing, and is now down to 15.98. By the end of this week, it'll probably be around 14.

So..those hopes of VIX in the 16-18 gap fill zone are going to be nigh impossible after this week.

I suppose its possible we could yet hit 14/15..pull back..then battle higher next week..but still..why would next week be any different than this week?

More later..on the indexes

Tuesday, 29 January 2013

Closing Brief - another day of melt

Another day higher, but then...why would it end? We're now 109 pts higher than the Dec'31st low - a mere 20 trading days ago. There is no sign of a turn..and the much sought retracement remains just that....sought, but missing.

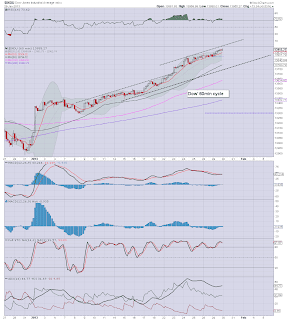

The hourly charts are bizarrely simple. What more is needed other than two straight upward sloping channel lines?

Dow'60min

sp'60min

Trans'60min

Summary

The algo-bot melt continues..and we're already now brushing up against what was the Feb/March target zone of 1510/20.

It has to be said, we ARE in the twilight zone of a new market era.

It needs to be considered..that this could continue...for some years to come.

--

*AMZN earnings...lousy. Q4 EPS 21 cents. The market was seeking 28 cents.

They still can't muster a decent profit..not even mediocre. Stock is -5%..which frankly is nothing of any significance. It remains over-valued by 90%, but hey..its the new era of stock valuations.

The hourly charts are bizarrely simple. What more is needed other than two straight upward sloping channel lines?

Dow'60min

sp'60min

Trans'60min

Summary

The algo-bot melt continues..and we're already now brushing up against what was the Feb/March target zone of 1510/20.

It has to be said, we ARE in the twilight zone of a new market era.

It needs to be considered..that this could continue...for some years to come.

--

*AMZN earnings...lousy. Q4 EPS 21 cents. The market was seeking 28 cents.

They still can't muster a decent profit..not even mediocre. Stock is -5%..which frankly is nothing of any significance. It remains over-valued by 90%, but hey..its the new era of stock valuations.

2pm update - relentless melt

Its just another day of algo-bot melt..fuelled by POMO $. How many more trading days will be necessary for the bears to fully capitulate? 50, 100, 500? Will it really take 1000 days for the very last bear in this market to understand what was meant by Bernanke last September when he announced QE3 t-bond buying (POMO)..'without end'.

Which part of 'without end' is confusing? It is the 'without'.. or the 'end' ?

I sure see a lot of bear maniacs posting cute little pics of a tiny little QE3/4 box on index charts..yet...for some reason they are making the bizarre notion that this QE is going to end. I don't get it, but then I happen to believe 'without end' means..the money printing is not scheduled to end.

I guess I'll remain the only one highlighting that little 'minor issue'.

--

sp'daily5

vix'daily3

Summary

So much for the VIX showing any strength, a close in the 12s now looks easily within range.

If Market likes the econ-data tomorrow, 1510/20s. but hey....even if its lousy numbers..what does it matter? Bulls have the algo-bots..and the Bernanke $.

--

AMZN earning at the close.

Very hard to guess whether that nonsense will ramp 20% on even lower - or NO margins, or whether they'll whack it 10/20% lower..only for it melt back higher into the spring.

After all, its AMZN, and it remains surrounded by hysteria.

-

back after the close.

Which part of 'without end' is confusing? It is the 'without'.. or the 'end' ?

I sure see a lot of bear maniacs posting cute little pics of a tiny little QE3/4 box on index charts..yet...for some reason they are making the bizarre notion that this QE is going to end. I don't get it, but then I happen to believe 'without end' means..the money printing is not scheduled to end.

I guess I'll remain the only one highlighting that little 'minor issue'.

--

sp'daily5

vix'daily3

Summary

So much for the VIX showing any strength, a close in the 12s now looks easily within range.

If Market likes the econ-data tomorrow, 1510/20s. but hey....even if its lousy numbers..what does it matter? Bulls have the algo-bots..and the Bernanke $.

--

AMZN earning at the close.

Very hard to guess whether that nonsense will ramp 20% on even lower - or NO margins, or whether they'll whack it 10/20% lower..only for it melt back higher into the spring.

After all, its AMZN, and it remains surrounded by hysteria.

-

back after the close.

10am update - bears still lack power

Despite a rise from sp'1398 to 1503, the bears are still lacking any energy to push this market back lower. Even 0.5% lower seems too difficult right now. VIX is still creeping a little higher, but remains in the 13s. The $ is moderately weaker..and is probably helping the precious metals..which are indeed somewhat higher.

sp'daily5

vix'daily3

Summary

So, the bears remain embarrassingly weak. Oh so weak.

A market rally/ramp from 1398 to 1503..and bears can't even manage a brief 1% decline. What is laughable is seeing anyone with the audacity to tout major declines in the mid term.

There simply is ZERO power on the bearish side.

On the contrary, the bulls have the algo-bots...and the Bernanke 'bux'. That free money will remain a major prop to this market.

--

Bears should keep their eyes to the VIX. A close in the mid 14s..would be particularly useful..and open up a spike into the low 16s as early as tomorrow.

-

updates...as necessary.

*don't forget, we have AMZN earning at the close.

sp'daily5

vix'daily3

Summary

So, the bears remain embarrassingly weak. Oh so weak.

A market rally/ramp from 1398 to 1503..and bears can't even manage a brief 1% decline. What is laughable is seeing anyone with the audacity to tout major declines in the mid term.

There simply is ZERO power on the bearish side.

On the contrary, the bulls have the algo-bots...and the Bernanke 'bux'. That free money will remain a major prop to this market.

--

Bears should keep their eyes to the VIX. A close in the mid 14s..would be particularly useful..and open up a spike into the low 16s as early as tomorrow.

-

updates...as necessary.

*don't forget, we have AMZN earning at the close.

Dollar weakness into the Spring

A quiet start to the week in market land. The US Dollar index closed fractionally higher, +0.04% @ 79.78. The daily cycle offers moderate near term upside to the 80.60 level. The USD 81s look somewhat unlikely, with the mid-term looking particularly weak.

USD, daily

USD, weekly

USD, monthly2, rainbow

Summary

The weekly USD chart continues to offer a very clear H/S formation. If correct, it would allow for very moderate near term upside, but more general downside into the spring. The downside target is 77.0. If that fails to hold, the monthly charts would offer 75/74 by late April/early May.

Despite continued QE for the foreseeable future, I do not expect a break under the April' 2008 low of 71.33. The USD sure is a very dirty bit of FIAT paper, but there are way more nasty ones out there, not least the Japanese Yen, whose bond market might be the first to implode in the next year or two.

Dollar weakness and the equity bears

As is often the case, if the dollar weakens to the 77s, and certainly if it declines to the 75/74 zone this spring, it would really help prop up the equity/commodity market- even if there is some mainstream concern over the debt ceiling, and renewed fiscal cliff issue.

If the H/S formation does play out - with significant dollar weakness, the equity bears will have a real tough time for at least a few more months. Sp'1520/30 in March seems viable, if not even higher, in the 1550/70s.

Looking ahead

I have some hope that Tuesday will see more dynamic price action. We've not seen a decent move in the equity indexes since the snap higher at the start of the year. This algo-bot melt is really tiresome, as I think many (not least the bears) would agree.

Those bears seeking an index retracement should remain focused on the VIX, where a Tue/Wed close in the 14/15s should be the first target. Whether the final exhaustion spike is to VIX 16 or18, that is the big unknown in my view.

Wednesday will be the best chance of a major bearish snap lower, with GDP, ADP jobs data, and the FOMC press release/statement.

Goodnight from London

USD, daily

USD, weekly

USD, monthly2, rainbow

Summary

The weekly USD chart continues to offer a very clear H/S formation. If correct, it would allow for very moderate near term upside, but more general downside into the spring. The downside target is 77.0. If that fails to hold, the monthly charts would offer 75/74 by late April/early May.

Despite continued QE for the foreseeable future, I do not expect a break under the April' 2008 low of 71.33. The USD sure is a very dirty bit of FIAT paper, but there are way more nasty ones out there, not least the Japanese Yen, whose bond market might be the first to implode in the next year or two.

Dollar weakness and the equity bears

As is often the case, if the dollar weakens to the 77s, and certainly if it declines to the 75/74 zone this spring, it would really help prop up the equity/commodity market- even if there is some mainstream concern over the debt ceiling, and renewed fiscal cliff issue.

If the H/S formation does play out - with significant dollar weakness, the equity bears will have a real tough time for at least a few more months. Sp'1520/30 in March seems viable, if not even higher, in the 1550/70s.

Looking ahead

I have some hope that Tuesday will see more dynamic price action. We've not seen a decent move in the equity indexes since the snap higher at the start of the year. This algo-bot melt is really tiresome, as I think many (not least the bears) would agree.

Those bears seeking an index retracement should remain focused on the VIX, where a Tue/Wed close in the 14/15s should be the first target. Whether the final exhaustion spike is to VIX 16 or18, that is the big unknown in my view.

Wednesday will be the best chance of a major bearish snap lower, with GDP, ADP jobs data, and the FOMC press release/statement.

Goodnight from London

Daily Index Cycle update

A rather quiet start to the week, but once again we saw the Transports and Rus'2000 put in new historic highs. Generally though, the main equity market closed broadly flat. The current accelerated up trend would appear very vulnerable to a near term 3% pull back.

IWM, daily

sp'daily5

Trans

Summary

So..its still kinda dull. The volume is kinda low, and the algo-bots are out there, always capable of melting this market up whilst the bears lack any downside power. With the Bernanke throwing the free money at the primary dealers (most days), the default trend remains UP.

However, a minor retracement STILL seems likely. A move down to sp'1450/40 is still very viable.

The giant gap @ sp'1425 now seems entirely out of range, and it might be some considerable time until we fill that one. Even the sp'1440s will become 'difficult' to hit after this Friday.

Bulls in control

Underlying momentum remains strongly bullish, and even a retracement of 3-4% would do absolutely nothing to dent the massive rally since the June 2012 low of sp'1266 - which is now around 20% lower.

So, lets see if Tuesday sees the VIX back in the 14/15s..and the SP' closing back under the big 1500.

A little more later

IWM, daily

sp'daily5

Trans

Summary

So..its still kinda dull. The volume is kinda low, and the algo-bots are out there, always capable of melting this market up whilst the bears lack any downside power. With the Bernanke throwing the free money at the primary dealers (most days), the default trend remains UP.

However, a minor retracement STILL seems likely. A move down to sp'1450/40 is still very viable.

The giant gap @ sp'1425 now seems entirely out of range, and it might be some considerable time until we fill that one. Even the sp'1440s will become 'difficult' to hit after this Friday.

Bulls in control

Underlying momentum remains strongly bullish, and even a retracement of 3-4% would do absolutely nothing to dent the massive rally since the June 2012 low of sp'1266 - which is now around 20% lower.

So, lets see if Tuesday sees the VIX back in the 14/15s..and the SP' closing back under the big 1500.

A little more later

Subscribe to:

Comments (Atom)