A busy and important week comes to a close, lets take a look at those daily index charts - via the Elder Impulse system.- which I tend to refer to as the 'rainbow' charts ;) The Green is usually a sign of a confirmed bullish trend, blue is flat/mixed/uncertain, and red is bearish trend.

IWM

NASDAQ Comp

Dow

NYSE Comp

SP'500

Transports

Summary

You can see small bear flags forming on all the index charts. From a MACD (green bar histogram) cycle perspective, we are low on the cycle and due for an up move. I would guess the bear flags have another 1-3 days to grow before they break lower towards the end of next week.

Considering the weekly and monthly cycles, I really believe these little bear flags will play out to the downside - as they often do, and by the end of May, the market will be significantly lower under sp'1300

Friday, 11 May 2012

Closing Brief

Welcome to the weekend. The market again closed weak. A quick look at the state of those hourly charts...

SP'60min

Dow'60min

IWM'60min

VIX'60min

--

An update on the daily cycles later in the evening, with a broader look - and plans and for next week, across this weekend.

SP'60min

Dow'60min

IWM'60min

VIX'60min

--

An update on the daily cycles later in the evening, with a broader look - and plans and for next week, across this weekend.

3pm update - another week comes to a close

A long day..a long week...I think we need a good weekend to recover...but even more important..to prepare for next week! Market trying to level out on the 15min cycle, although the 60min cycle is still on the slide in terms of momentum.

I think its just a tease to the bears again..C' wave should go to 1370/75 at least on Monday. The thing I'm fuzzy on is whether we can get a further brief up move early Tuesday to 1380/85. Retail Sales data is due 8.30am EST Tuesday, and if it came in good, it would make for a nice spike high on the C' wave, and then we can start to level out and being wave'3.

Sp'15min

*looks like an inverse H/S is setting up on the 15min cycle...so long as not break 1354..should be fine for the C' wave.

Sp'60min

I've added a bear flag (black lines)...that should narrow the target range for next Mon/Tue.

More after the close.

I think its just a tease to the bears again..C' wave should go to 1370/75 at least on Monday. The thing I'm fuzzy on is whether we can get a further brief up move early Tuesday to 1380/85. Retail Sales data is due 8.30am EST Tuesday, and if it came in good, it would make for a nice spike high on the C' wave, and then we can start to level out and being wave'3.

Sp'15min

*looks like an inverse H/S is setting up on the 15min cycle...so long as not break 1354..should be fine for the C' wave.

Sp'60min

I've added a bear flag (black lines)...that should narrow the target range for next Mon/Tue.

More after the close.

2pm update - C is for Cookie...(and Crash)

A minor down wave on the 15min cycle - as expected, kicking out the weak bulls, and now we'll trundle largely sideways into the close.

There is a lot of talk out there in chart land about these little corrective ABC waves, perhaps the following can put things into perspective. Certainly, it makes for a break from watching clown channel.

Sp'60min - count'2

*The bulls will want to see a close over the 10MA '1360, they might get it, I'd guess they probably will. The issue is how high do we go on Monday? I'd guess at least to 1370/75. There remains the possibility that C' wave might last into Tuesday..and hit the 50% fib retrace of 1379/80. That would be a far safer level to re-short. Being a patient Bear will be important next week.

This mornings action does give me good confidence that the original outlook was indeed correct, that wave'1 and now 2 are indeed correctly identified, and by definition...wave'3...begins later next week.

...I guess its time to flick back to those cheer-leading maniacs on clown channel...

Yours...no fan of Cookies..but does like a good old fashioned Crash

There is a lot of talk out there in chart land about these little corrective ABC waves, perhaps the following can put things into perspective. Certainly, it makes for a break from watching clown channel.

Sp'60min - count'2

*The bulls will want to see a close over the 10MA '1360, they might get it, I'd guess they probably will. The issue is how high do we go on Monday? I'd guess at least to 1370/75. There remains the possibility that C' wave might last into Tuesday..and hit the 50% fib retrace of 1379/80. That would be a far safer level to re-short. Being a patient Bear will be important next week.

This mornings action does give me good confidence that the original outlook was indeed correct, that wave'1 and now 2 are indeed correctly identified, and by definition...wave'3...begins later next week.

...I guess its time to flick back to those cheer-leading maniacs on clown channel...

Yours...no fan of Cookies..but does like a good old fashioned Crash

1pm update - a brief glimpse into next week

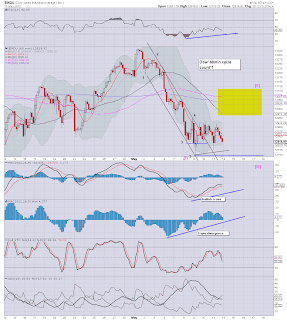

Whilst the market trundles between 1358/68 for the rest of today, lets take a look at the daily chart.

Sp' daily, bearish scenario

So..where are we?

We have a large H/S, and a good break below the rising trend line (grey line, May 8'th). The 10MA has re-crossed below the 50day MA - a big bearish sign!

In terms of the MACD (blue bar histogram) cycle, we are cycling back upward...however, I expect this to fail and rollover by next Thursday/Friday. Such a rollover below the 0 line, after often the very best warnings of major snaps to the downside..

The 1340 level will be the next warning to anyone who is still looking for another high sp>1422. A break under 1340 likely means a fast move to 1270/80 - where the 200day MA is. Interestingly, in May' 2010, the market fell 30pts under the 200 day on that infamous flash-crash Thursday. So, perhaps we could look for sp'1250 - that would certainly be the next level under the 200MA. SP'1200 would appear to be 'best doom case' for May/June.

--

If the count on the daily chart is correct, then wave'3 (black count) should start no later than the end of next week.

Lots more to cover, but that can be done over the weekend. The bears have some important planning to do!

More later..on what is becoming a quiet Friday afternoon.

Sp' daily, bearish scenario

So..where are we?

We have a large H/S, and a good break below the rising trend line (grey line, May 8'th). The 10MA has re-crossed below the 50day MA - a big bearish sign!

In terms of the MACD (blue bar histogram) cycle, we are cycling back upward...however, I expect this to fail and rollover by next Thursday/Friday. Such a rollover below the 0 line, after often the very best warnings of major snaps to the downside..

The 1340 level will be the next warning to anyone who is still looking for another high sp>1422. A break under 1340 likely means a fast move to 1270/80 - where the 200day MA is. Interestingly, in May' 2010, the market fell 30pts under the 200 day on that infamous flash-crash Thursday. So, perhaps we could look for sp'1250 - that would certainly be the next level under the 200MA. SP'1200 would appear to be 'best doom case' for May/June.

--

If the count on the daily chart is correct, then wave'3 (black count) should start no later than the end of next week.

Lots more to cover, but that can be done over the weekend. The bears have some important planning to do!

More later..on what is becoming a quiet Friday afternoon.

12pm update - afternoon chop

Market remains behaving as I expected. Looking for a minor rollover after 1/2pm, and closing somewhere around sp'1362/64. I suppose we could close 1370, but I think that is more likely for Monday.

SP'60min count'2.

VIX'60min

The giant black candle on the VIX at the open was indeed precisely what I looking for, and for the indexes we saw hollow-red reversal candles. It doesn't get much better that that.

---

As noted...I am sitting this out until Monday or Tuesday.

The MONSTER wave'3 is still due...good bears will be carefully planning their re-short levels for next week, along with GOOD short-stops.

--

Time for lunch !

SP'60min count'2.

VIX'60min

The giant black candle on the VIX at the open was indeed precisely what I looking for, and for the indexes we saw hollow-red reversal candles. It doesn't get much better that that.

---

As noted...I am sitting this out until Monday or Tuesday.

The MONSTER wave'3 is still due...good bears will be carefully planning their re-short levels for next week, along with GOOD short-stops.

--

Time for lunch !

11am update - C' wave UP...underway

I'm taking it easy in the bear bunker. No trades, I'm just going to watch the algo-bots ramp this nonsense to around 1375/80 next Monday afternoon/Tuesday morning.

It has been especially pleasing to see the black candle on the VIX, and the red hollow (reversal) candle on the indexes - as expected!

-

SP'60min, H/S formation

More later...

yours...awaiting the C' wave target ;)

It has been especially pleasing to see the black candle on the VIX, and the red hollow (reversal) candle on the indexes - as expected!

-

SP'60min, H/S formation

More later...

yours...awaiting the C' wave target ;)

10am update - target remains sp'1380

Everything on track.

ALL targets met, however, I decided to keep today simple, no trading until C' wave tops next Monday/Tuessday.

IWM'60min

VIX'60min

So, I ain't hitting any buttons. Being the permabear that I am, going long is not the most calming of feelings.

SP'1380 remains the target.

More later!

ALL targets met, however, I decided to keep today simple, no trading until C' wave tops next Monday/Tuessday.

IWM'60min

VIX'60min

So, I ain't hitting any buttons. Being the permabear that I am, going long is not the most calming of feelings.

SP'1380 remains the target.

More later!

Pre-Market Brief

Good morning. Well, overnight futures got down to within 1pt of the recent sp'1343 low. As I type, futures are 5pts higher from that low...and we are due to open marginally lower around sp'1352/54.

Things to look for in the opening 10/30 minutes!

VIX'15/60min cycle - black candles - indicating a failed opening gap

Red hollow reversal candles on the indexes, especially IWM, which often leads the market.

VIX'60min - note those black candles often marking tops!

Sp'60min

If we did indeed see the A' wave peak yesterday, then we are most certainly due to see B' wave floor - most likely early this morning. I'd still guess C' wave UP does not complete until Monday afternoon at the earliest.

I suppose its possible we won't even get past 1370. C' wave by definition only have to pass the A' wave peak of 1365.88. However, the 50% fib is 1379/80, and it feels like the indexes will be drawn to that SEVERE resistance zone..before the monster wave begins.

*note the dashed grey line on the chart, which by Monday will be a reinforced-concrete wall at the 1380 level.

--

So..we have a long day ahead.

As it is, I am looking to go long, once I see the 15min cycle level out. Further, if I do see a black candle on the VIX 60min chart at 10am (I'll sure post it up!)..then I'd believe that it is a good sign the market has floored..and UP we shall go.

'Serious money' long-stops would of course be around 1343 or so. Right now I don't believe we'll go much below 1352/50.

Good wishes for Friday trading....its almost time for the weekend!

Things to look for in the opening 10/30 minutes!

VIX'15/60min cycle - black candles - indicating a failed opening gap

Red hollow reversal candles on the indexes, especially IWM, which often leads the market.

VIX'60min - note those black candles often marking tops!

Sp'60min

If we did indeed see the A' wave peak yesterday, then we are most certainly due to see B' wave floor - most likely early this morning. I'd still guess C' wave UP does not complete until Monday afternoon at the earliest.

I suppose its possible we won't even get past 1370. C' wave by definition only have to pass the A' wave peak of 1365.88. However, the 50% fib is 1379/80, and it feels like the indexes will be drawn to that SEVERE resistance zone..before the monster wave begins.

*note the dashed grey line on the chart, which by Monday will be a reinforced-concrete wall at the 1380 level.

--

So..we have a long day ahead.

As it is, I am looking to go long, once I see the 15min cycle level out. Further, if I do see a black candle on the VIX 60min chart at 10am (I'll sure post it up!)..then I'd believe that it is a good sign the market has floored..and UP we shall go.

'Serious money' long-stops would of course be around 1343 or so. Right now I don't believe we'll go much below 1352/50.

Good wishes for Friday trading....its almost time for the weekend!

The market trend IS down

Despite the mild hysteria from the hosts on the clown channels today - due to the sight of moderately green indexes, the broader trends are still warning of major downside. Lets just keep this very simple...but elegant chart in mind!

Sp'monthly, 6yr

Only if we break the previous sp'1422 peak can anyone justifiably get bullish again. Arguably, the shorter term traders should at least have somewhat tighter short-stops around 1385/95.

Friday will be interesting. I'm not sure if I'll risk taking a brief long trade - in anticipation of the C' wave up. A move from 1350 to 1375/80 would be pretty profitable, but its certainly not without some moderate risk. As noted earlier, with Futures -10 (as at 6.35pm EST), we are dangerously close (just 5pts) from taking out the previous low of 1343.

Right now, I'd guess futures recover a little overnight, with a floor early Friday morning around sp'1352/48, and that we do still see a C' wave peak early next week.

Goodnight from London

Sp'monthly, 6yr

Only if we break the previous sp'1422 peak can anyone justifiably get bullish again. Arguably, the shorter term traders should at least have somewhat tighter short-stops around 1385/95.

Friday will be interesting. I'm not sure if I'll risk taking a brief long trade - in anticipation of the C' wave up. A move from 1350 to 1375/80 would be pretty profitable, but its certainly not without some moderate risk. As noted earlier, with Futures -10 (as at 6.35pm EST), we are dangerously close (just 5pts) from taking out the previous low of 1343.

Right now, I'd guess futures recover a little overnight, with a floor early Friday morning around sp'1352/48, and that we do still see a C' wave peak early next week.

Goodnight from London

Euro currency - ready to drop hard

Just a quick update on the Euro. Both the daily and weekly cycles remain weak, there is nothing bullish about the near or mid term for the Euro. Conversely, that should mean the Dollar strengthens, which will put extra downward pressure on both the equity and commodity markets.

Euro, daily

Euro, weekly

Summary

We could easily briefly back test the 1.30 level, and/or the daily 10MA of 1.31. In terms of downside, primary target remains 1.25/24. If we don't see a bounce off that level, then further falls to the 1.20/19 level would occur. Look for a snap move lower next week.

Euro, daily

Euro, weekly

Summary

We could easily briefly back test the 1.30 level, and/or the daily 10MA of 1.31. In terms of downside, primary target remains 1.25/24. If we don't see a bounce off that level, then further falls to the 1.20/19 level would occur. Look for a snap move lower next week.

Subscribe to:

Comments (Atom)