We are due some sort of 2-3% move lower, yet even that's arguably a 'moderate chance'. The bears have a real problem. Underlying momentum on the big weekly and monthly cycles remains UP. It will take a major decline to the sp'1340s, just to level out the bigger cycles, and I honestly can't see that happening any time soon.

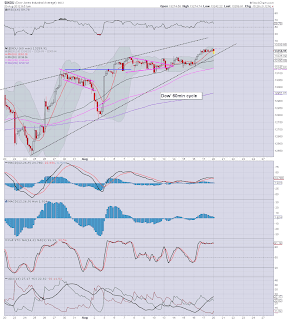

dow'60min

dow, daily

Summary

The dow seems to be the index first likely to break below the wedge.

On the daily, you can see we have a pretty good chance at a pullback, but it will probably be no lower than the recent low of 12800, and maybe not even 13000. So, again, bears might only get 2% lower between now and early next week.

Until the infamous 'Jackson hole' is out of the way, and the FOMC of Sept'13, it sure doesn't look good trading weather for the bears.

VIX is up 6%, but at such low levels, its all noise. Only with a move into the 18s, can the VIX be taken seriously.

*Next update 12pm.