Hmm, not a good end to the day for the bulls. However, selling vol' was arguably light, and overall there was no real drama today. The main delusion that 'everything is gonna be okay' seems still intact.

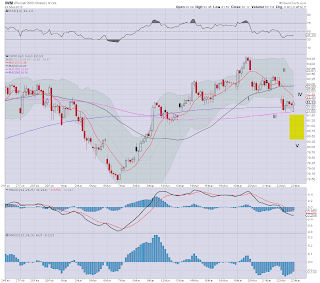

IWM 60min cycle

We have a clear secondary bear flag on IWM and across most of the other indexes. A further move lower early Friday seems highly likely. That might make for a very clean 5 micro-waves lower, and then maybe that's that, before the next major wave high to sp'1440.

SP Daily

Sp' remains still very strong overall from a daily perspective. However, it is due to go negative cycle (see MACD) Friday. Overall, the daily is pretty bearish.

*I've left an old count on that chart, right now, no idea what to think. Did we really put in a top at the 1414 level?

VIX Daily

VIX is set to go positive cycle Friday, the first major line will be upper bol' of 20.

In Closing

Short term cycles are bearish across the board. It would seem we make another new short term low this Friday, and then maybe we truly start to complete a floor.

The notion we open up 0.75% or more Friday, and keep going up is viable, but..considering the daily cycles, the odds are highly against it. If the market really wants to wreck the bears weekend, it will gap this market back over the 10 MA on the 60min cycle tomorrow, and trend upward...ALL day.

more later....