It was a bearish week for US equity indexes,

with net weekly declines ranging from -3.8%

(R2K), -3.2% (Nasdaq comp'), -1.5% (Trans), -1.0% (sp'500), -0.7% (NYSE comp'), to

-0.04% (Dow). The m/t trend remains bullish.

Lets take our regular look at six of the main US indexes (monthly candle charts)

sp'500

The sp' saw a net weekly decline of -1.0%, having swung from 2939 to settle at 2885. Note the key 10MA at 2776, which is 109pts (3.8%) lower. Unless the bears can break AND hold under that for a monthly close, the m/t trend has to be deemed as still m/t bullish.

Big target resistance zone of 2950/3047 is indeed near. A break above the Fibonacci 2.618x extension/extrapolation of 3047 will offer far higher levels, and its notable the Dow has already decisively broken above its equivalent of 26702.

Original year end target of 3245 looks a stretch. However, consider that if we're trading at 3000 in mid November (notably after the midterms), target will be 245pts (8.2%), and would still be just about viable. Any progress in US/China trade relations would clearly help.

Nasdaq comp'

The Nasdaq comp' settled the week net lower by a very significant -3.2% to 7788.

Dow

The mighty Dow settled -11pts (0.04%) to 26447, but having broken a new historic high of 26951.

NYSE comp'

The nyse comp' settled -0.7% to 12991.

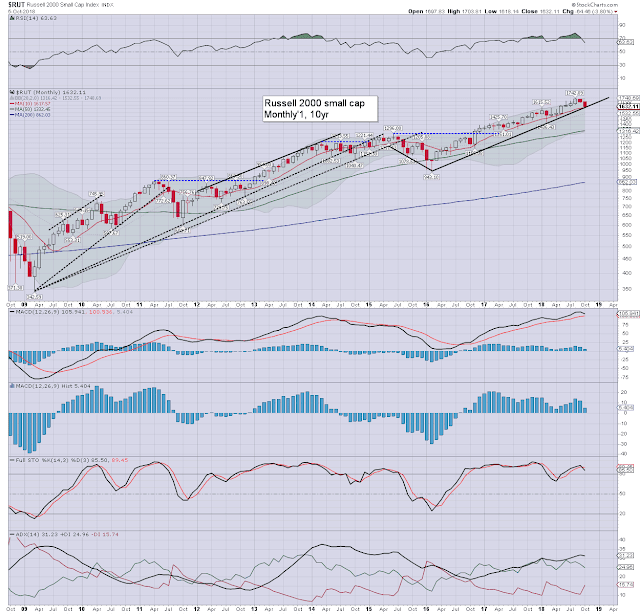

R2K

The R2K was the weakest index this week, settling lower by a very significant -3.8% to 1632.

Trans

The 'old leader' - Transports, settled -1.5% to 11206. Higher WTIC/fuel prices remain an issue, but are so far still being over-ridden by an expanding US/world economy.

–

Summary

All six US indexes were net lower for the week, lead by the R2K and Nasdaq comp'.

The Dow broke a new historic high, settling the week just fractionally lower.

YTD performance:

The Nasdaq comp' continues to lead the way, currently +12.8%, with the spx +7.9%, and the Dow +7.0%. The R2K is now +6.3%, with the Trans +5.6%, and the nyse comp' lagging at +1.4%.

--

Looking ahead

Key earnings: DAL (Wed'), JPM, C, WFC, PNC (Fri')

M - Columbus day - US bond market CLOSED. Equity market open.

T -

W - PPI, wholesale trade,

T - CPI, weekly jobs, EIA Pet' and NG report

F - Import/export prices, consumer sent'

--

If you value my work, subscribe to me.

For details:

https://permabeardoomster.blogspot.co.uk/p/subscriptions.html

Have a good weekend

--

*the next post on this page will likely appear 5pm EST on Monday.