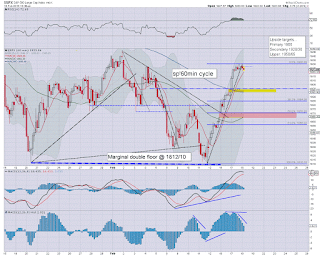

sp'60min

VIX'60min

Summary

*VIX breaks a new cycle low of 21.72, which is wrecking hopes of even moderate equity downside this afternoon.

--

Clearly, there really isn't any downside power right now.

It could easily be argued though.. we've a short term top... due a retrace - probably no lower than the sp'1900 threshold.

However, the daily cycle remains powerfully bullish, and I'd be concerned about launching any shorts from current levels.

*will update a daily chart later... as I do realise 2K is a threat.... although still looks difficult.

--

Here in London city....

| Another day closer to summer |

| Behold.. the rising moon! |

After yesterday's grey horror, today is better.. and yet more cranes are appearing. The London crane index must be close to historic highs... and that usually marks a cyclical peak.

-

time to cook

-

11.01am: Oil inventory weekly surplus: 2.1 million.... contrary to yesterday's API.

Equities being dragged lower.... sp -7pts.. 1919.. ohh the humanity!

For the moment though.. VIX is NOT confirming... and remains -2.5% in the 21.70s....

-

11.25am.. Well... with things as they are... we'll see an hourly MACD bearish cross at 12pm... solidifying a retrace for rest of today. First target is the sp'1900 threshold. Fibonacci would be more suggestive of 1884.

In any case....we ain't closing significantly higher for a fourth day.

VIX is STILL fractionally negative.... pretty bizarre.