US equities closed moderately mixed, sp +1pt @ 1923 (intra low 1901). The two leaders - Trans/R2K, settled lower by -0.5% and -0.4% respectively. There is high probability that the market has put in a short term floor, with viable upside into the next FOMC of Wed' Jan'27th. The 1990s remain best case for the equity bulls.

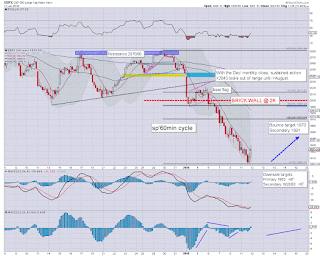

sp'60min

Summary

*closing hour action: a test of the low @ 1905, but spiking to 1930... settling above the key 10MA

--

Well, the closing hour offers very strong support that we've a short term floor from 1901.. with VIX 27s.

Now its a case of giving the market some days to battle to the 1970s.

*I'll have to give extra focus to the daily MACD cycles.. which could fail to break back above the zero threshold next week.

**to those who went long.... enjoy the ride. I'm content to just watch and wait for the next short opportunity.

--

Another flashback to the 1980s...

How many times have I listened to this whilst going on the London underground transit system? A great many indeed.

... and yes, Labyrinth is a fave' movie of mine.

This market.... has no power over me.

--

more later.... on the VIX