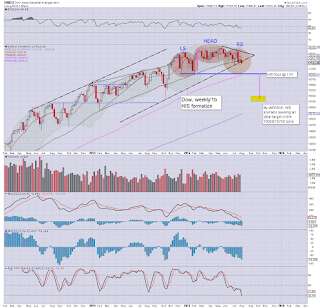

With key technical breaks on a number of individual stocks (today, notably AAPL), there is increasing clarity about the outlook across the next few months. The Dow looks headed for the 17k threshold, with the sp' back to the 2050/25 zone. A break under 2K looks out of range in the current cycle.

Dow'weekly1b

sp'daily5

Summary

*notable weakness in Oil, -3.5% in the $45s. The March low of $42s is set to be broken.. with first target of the psy' level of $40... and that certainly won't help energy stocks/broader market.

---

So.. here we are.. a little morning chop.. but with few buyers.. the market has broken lower.

Right now, the key break in AAPL should flag up all sorts of warnings for those broadly long the market.

Considering the VIX is only in the 13s... - with 16/17s viable within a few days... the sp'500 looks set for a daily close under the 200dma - currently @ 2069, later this week.

-

Notable weakness, metals, Gold -$5, with Silver -1.7%.... and that is with the USD still to break back above the giant DXY 100 level.

Consider the implications if DXY 120s next year.