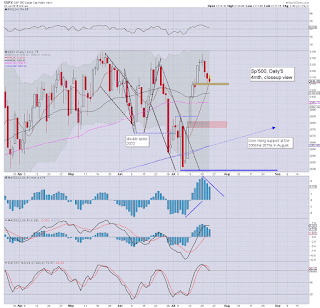

US equities open with some minor chop, but are looking increasingly vulnerable across today, and likely.. into early next week. There remains significant probability of a full retrace to around sp'2080.. along with VIX 15s, before renewed upside into August.

sp'daily5

VIX'daily3

Summary

*opening reversal candles starting to appear.. as buyers are simply absent at these levels.

--

Daily MACD (blue bar histogram) cycles for equity indexes and the VIX are both continuing to turn back toward the equity bears.

However, at the current rate, we won't see a more significant move for another 2-3 days, so the best case target of 2080 does not look viable until next Mon/Tuesday.

--

notable weakness: QCOM

Ugly daily chart across the past year. My broader downside target is 58/54

-

10.01am.. Leading indicators +0.6%.... broadly inline, and an 'okay' number.

Equities set to break new retrace lows.. <2110.