The equity bulls have had the best part of two trading days to exit in the 1750s. There is a clear 40pts of downside to the 200 day MA of sp'1709. There can be no excuses for anyone complaining this Thurs/Friday that 'ohh..we're so surprised at another big fall!'.

sp'60min

Summary

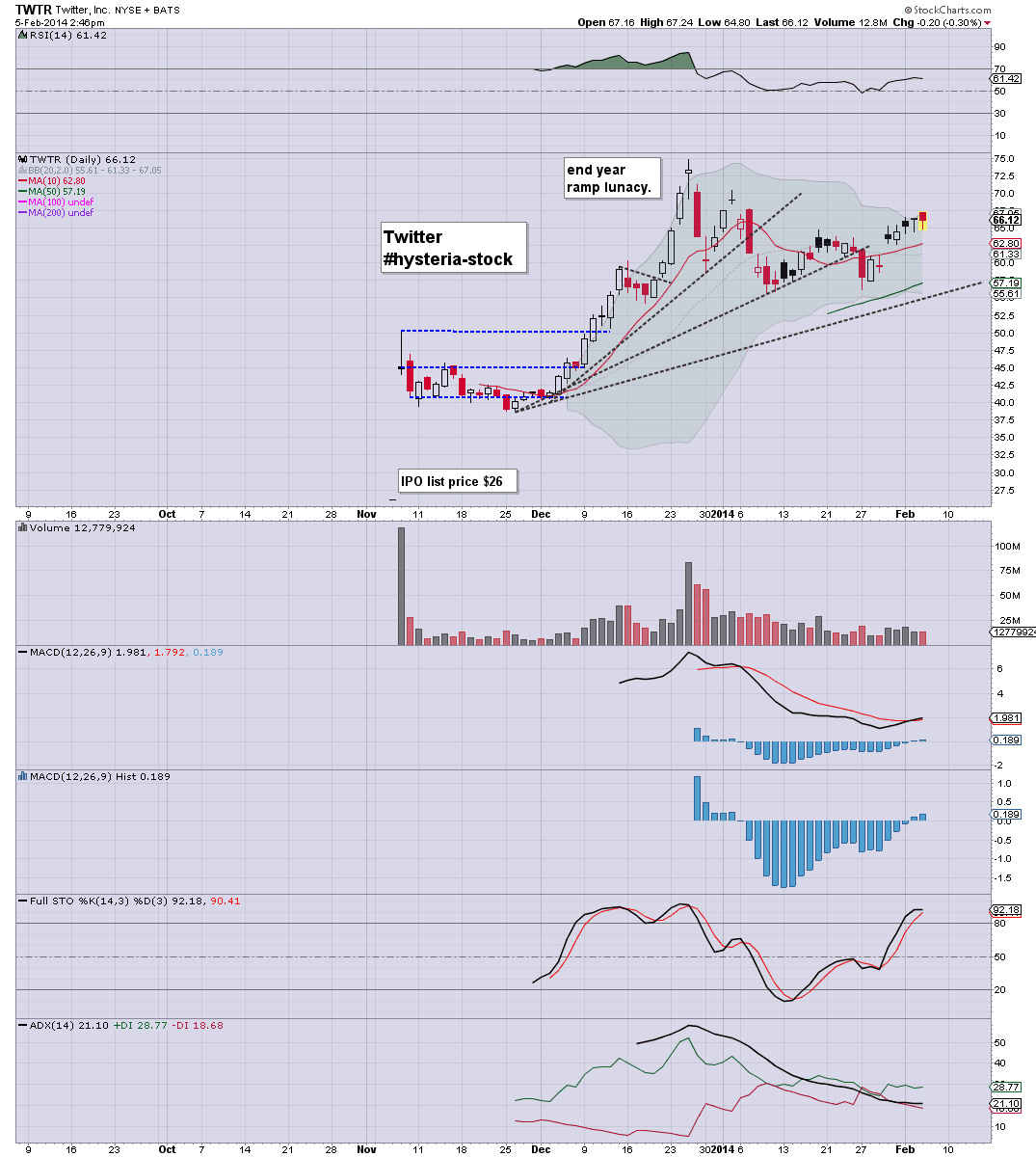

*TWTR earnings at the close, which might be kinda fun to watch

The daily chart is a bit of a mess...

Upside looks difficult, natural downside would be 60/55. I've no idea on what earnings might be, but my guess would be that the market sells TWTR lower on a good..or bad number.

Since its one of the 'hysteria' momo stocks, I'd never trade it, but I'll sure watch it for entertainment purposes ;0

--

As for the main market...we will have a hard resistance wall of sp'1760 at the close - via the hourly upper bollinger. Frankly, I can't see the 1720/10s not being hit by the Friday close.

-

...updates into the close...

3.10pm.. chop continues. Just who is going to want to go here?

VIX looks primed on the hourly charts.

-

The important thing about today..we did break a new low of sp'1737, and that certainly bodes well for the bears in the remainder of the week.

TWTR : -0.3% , ahead of earnings...

-

3.19pm... chop chop chop...but the weakness IS there. VIX looks so primed, its gonna be real important to the equity bears to break into the 22s (above the 2013 high of 21.91) in the next two days.

It should give complete clarification of the bigger bearish picture for the next few months.

Coal miners ...real stinky today.. BTU -3.6%

3.32pm... everyone getting a chance to be positioned (however they wish) during this continued chop.

There can be no excuses tomorrow..or more importantly...the Friday open. VIX holding minor gains of 2%, a third day..holding the upper teens.

3.40pm... VIX hourly update...

There is minor risk of downside to the mid 18s tomorrow, whilst upside is a clear break into the 22s, above the 2013 high. Considering the bigger daily/weekly trends..it looks a very positive setup.

3.49pm I realise some are still seeking a back test of the old 1770 support..but really, that seems..difficult. 15pts upside..vs 45/50pts downside. Risk/reward really favours the bears.

back at the close!