Welcome to May! Market is opening moderately weak. Bears need to see sp<1570s, with VIX 16/17s to know this latest up wave is complete. Precious metals and Oil are very weak, and both are possible leading warnings for the equity market. USD is still weak, -0.3%

sp'60min

vix'60min

Summary

So...a little weakness to start the day, but its nothing significant yet. In fact, baring a break <1570, I won't be the least bit pleased.

Its been a rough past 7 days for the bears, and the obvious big target is the 1536 low. That is an awful long way down right now, and I find it hard to imagine the market getting spooked enough across the next few days to have any chance of hitting that.

As ever, look to the VIX. If we see some power in the VIX, 15/16s, then it would open the door to an 'interesting' Friday.

--

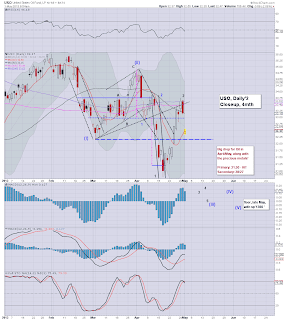

*I will be focusing on Oil especially this week, since I am short USO from the low 33s.

Oil is confirming a turn lower...

I am seeking USO in the mid 31s. If the market unravels...then 28/27 is the bigger target for a key multi-month low.

10.11am.. market looks to have broken the narrowing wedge on the index charts.

First target remains the sp'1570 threshold. Bears should be seeking a daily close under that this week. VIX in the 14s...I'd like to see 15s later in the day.