With the indexes all closing higher today - after early morning moderate losses, the bulls are probably feeling pretty confident for next week. I'd actually agree next week will probably have follow through to the upside. A further 2-3% though, that's all they are probably getting.

IWM, bearish

The bears who are looking for a wave'2 to quickly max out - as part of an overall bearish outlook to sp'1100, will want to see IWM not break over 80.00 next week.

Dow

Upside target on the dow is in the 12750/850 range. A move over 13,000/100, would probably ruin the main bearish outlook for the next few months.

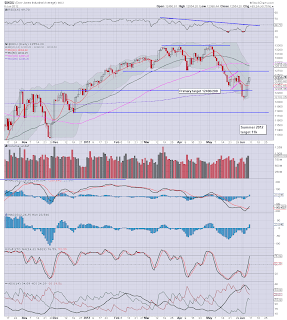

Sp, bearish

Upper target range remains 1350/60. A move over 1380 would arguably violate the overall bearish outlook. I find it near impossible to envision a realistic scenario where the SP' can break to new highs >1422 at any point this year, never mind the next month or so.

Transports

The tranny is back above the big 5k level, target range for next week, somewhere around 5150/200. A move over 5300/350 would ruin the bearish outlook.

Summary

I think the coming week will offer some good opportunities to take on new tactical short positions. The good thing is that the key short-stop levels are very clear, with the only issue being how tight a stop a given trader wishes to use.

*watching Bloomberg TV just earlier, a guest David Kotok (Cumberland Advisers) who was touting sp'2000 by the year 2020. He is looking for the year to close around sp'1450/1500. Good luck with that bold call Mr K.

Its pretty amusing that after just 3 days of ramp, the bulls are out once again proclaiming new hyper ramp targets. Just reflect on the fact that a mere five trading days ago, most of them were on suicide watch after the dow closed -270pts.

--

Overall, sp'1350/60 remains a very valid target for next week, and I hold to that original outlook.

--

Across the weekend, I will probably post an update on the weekly index charts, and I've a new VIX chart to throw out there (see Zerohedge, for article on Citi who were noting VIX'80, if 'disorganised Greek exit').

Good wishes